Jun 23, 2022

Traders are stockpiling the most cash in a decade: JPMorgan

, Bloomberg News

Bubbles do burst and rational investing returns in long term: Chairman and founder

In the view of JPMorgan Chase & Co. strategists, the reason why this may be the end of the bear market is that investors are holding way too much cash.

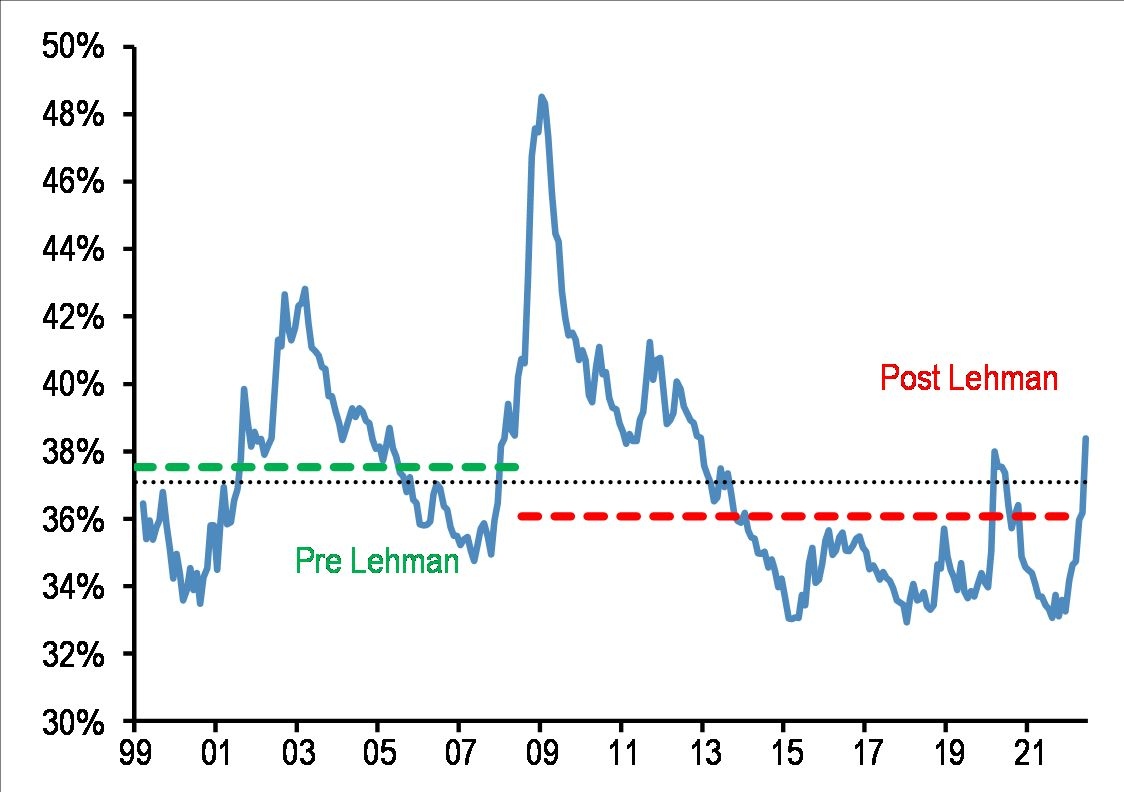

Nikolaos Panigirtzoglou estimates that cash levels are close to 40%, the highest level in a decade. JPMorgan tracks a metric based on holdings of stocks, bonds and cash that’s outside of central banks and commercial lenders.

This is “perhaps the bottom for both equities and bonds,” Panigirtzoglou said in an interview.

He’s holding onto a long-time bull call in stock and bonds, despite prices moving against his predictions recently. With so much cash available, markets should find support in the coming months, he said.

JPMorgan’s pro-risk stance hasn’t worked out so far this year. The bank’s strategists have been steadfastly optimistic on stocks, even as the S&P 500 plunged into a bear market.

Investors have flocked to cash to find safety from this year’s historic losses. Raging inflation and the Federal Reserve’s rush to raise interest rates have chilled risk appetite and put an end to easy money on Wall Street.