Sep 26, 2022

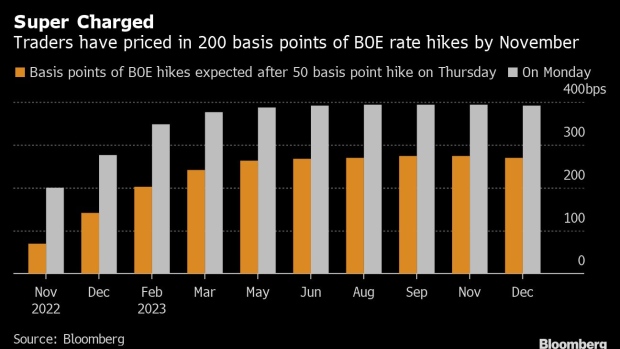

Traders Bet BOE Will Hike Rates 200 Basis Points by November

, Bloomberg News

(Bloomberg) -- Traders ramped up wagers on the scale of interest-rate hikes by the Bank of England in the short term, to deal with markets in turmoil over the government’s economic plans.

Money markets priced in more than 200 basis points of increases by the BOE’s next meeting in November, four times the size of its last hike. The deposit rate currently stands at 2.25%.

Investors have dumped UK bonds, while the pound trimmed its losses after sliding to a record low in Asian trading.

Read more: UK Tories Look to BOE to Step In to Halt Panic Over the Pound

©2022 Bloomberg L.P.