Feb 24, 2022

Traders cling to Fed, ECB rate bets despite Ukraine invasion

, Bloomberg News

Bond exposure will protect investors' portfolios if the Fed overshoots inflation target: Strategist

Rates traders caught between inflationary pressures spurred by Russia’s invasion of Ukraine and the potential impact on economic growth aren’t bailing on their tightening bets yet.

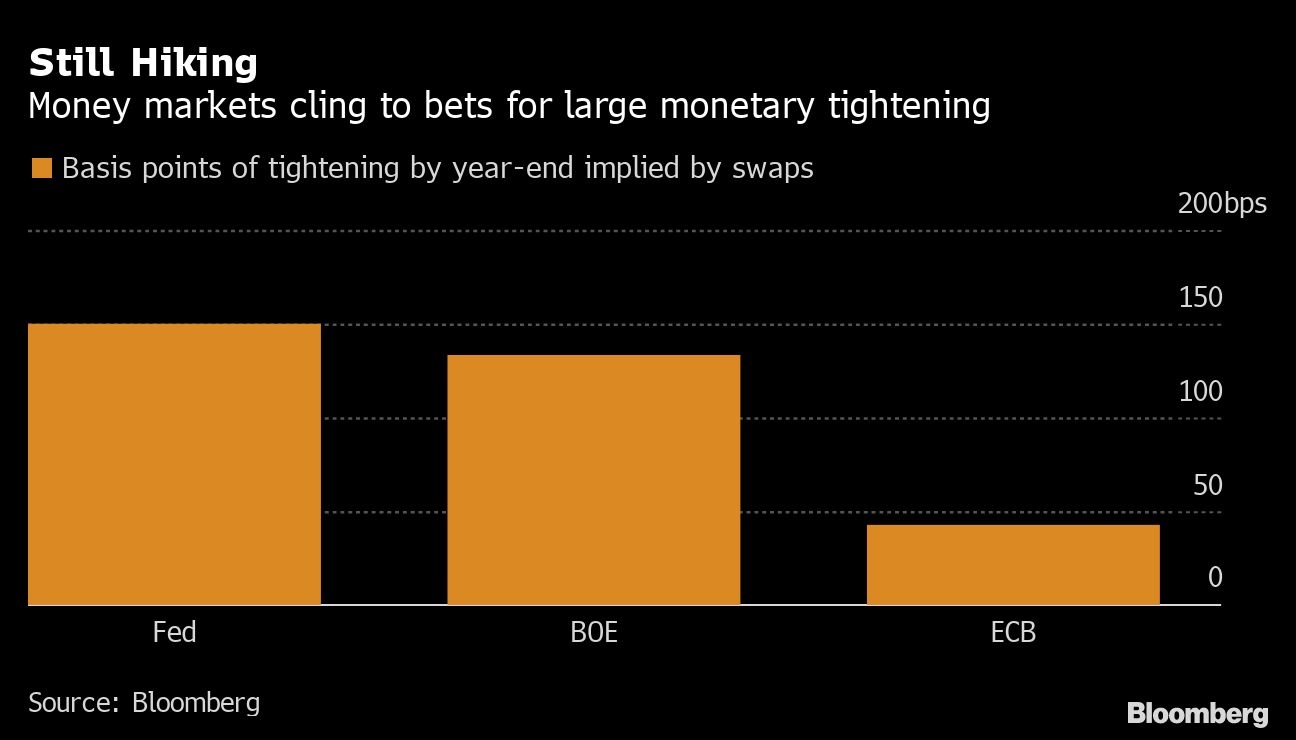

While wagers were trimmed slightly on Thursday, six quarter-point hikes are still expected by the Federal Reserve, five by the Bank of England and one by the European Central Bank by year-end. That’s in line with what was priced before Russia launched a barrage of missile, artillery and air attacks across Ukraine, sending Brent crude above US$100 a barrel for the first time since 2014.

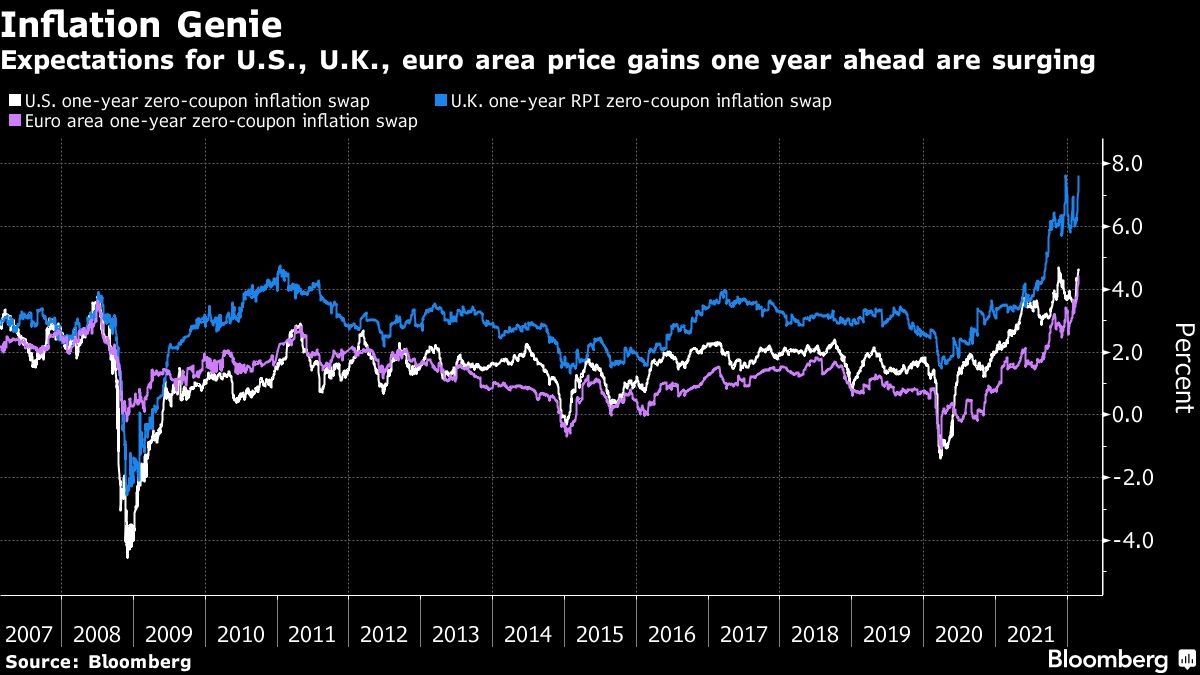

Underpinning the steadfast positioning is concern that military operations could disrupt key energy and commodity supplies and continue to push prices higher. A gauge of one-year inflation expectations in the euro area and the U.K. both surged to a record.

“The question is at what point, if ever, does the rates market narrative around the Russia-Ukraine crisis shift from one that is narrowly focused on short-term inflation risks, to one that is more concerned about the potential medium-term deflationary impact,” said Vanda Research’s global macro strategist Viraj Patel.

Policy makers have had to juggle the highest price pressures in decades with growth concerns as they wind down stimulus unleashed to keep their economies afloat during the pandemic. March is a major month for monetary policy with investors bracing for clues on the speed and extent of tightening that’s to come.

Money markets have fully priced a quarter-point rate hike from the Fed on March 16 and the BOE a day later and are hedging for the possibility of a larger increase. Meanwhile, the ECB is expected to sketch out its policy path at its March 10 meeting, when it also presents new economic forecasts.

A gauge of one-year inflation expectations in the euro area and U.K. jumped 37 basis points and 88 basis points respectively on Thursday. Still, some analyst expect the latest developments will prompt investors to scale back their bets on the pace of rate hikes needed.

“The conflict is likely to encourage market participants to scale back expectations for monetary tightening from major central banks in the near-term,” said Lee Hardman, a foreign exchange strategist at MUFG in London.

“We would expect the U.K. and U.S. rate markets to continue to adjust expectations more in favor of smaller 0.25 point hikes being delivered at their next meetings in March rather than 0.50 point hikes to reflect the heightened uncertainty,” he said.