Jan 26, 2022

Traders Dump Emerging Market Bonds as Fed, Ukraine Jitters Mount

, Bloomberg News

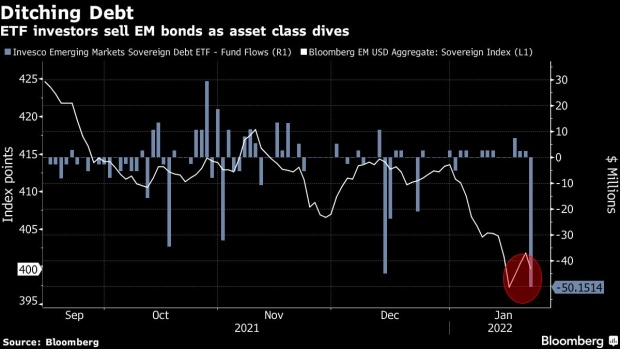

(Bloomberg) -- Money managers are pulling money from emerging-market bond funds at the fastest pace in months as anxiety builds over tighter monetary conditions and the threat of a conflict over Russia’s troops at the Ukraine border.

The $18.4 billion iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB) lost $387 million on Monday, the largest outflow since March. The $2.5 billion Invesco Emerging Markets Sovereign Debt ETF (PCY) had a $50 million withdrawal, the largest in over a year.

The losses come as investors brace for Federal Reserve policy makers to signal a rate hike in March at the end of their meeting Wednesday, as inflation roars in the U.S. amid supply bottlenecks and a rebound from the pandemic’s economic downturn. Those expectations have led to a volatile start of the year for U.S. bonds, to which their developing-world peers are traditionally sensitive.

“Spreads widen out as the Fed gets more hawkish,” said Win Thin, global head of currency strategy for Brown Brothers Harriman & Co. in New York. “A lot of the flows generated by quantitative easing went into EM and high yield. With quantitative tightening coming up along with rate hikes, I can’t see how spreads don’t widen further.”

Meantime, a possible conflict is brewing between Russia and the West as Moscow builds up troops in the border with Ukraine. The geopolitical issue has sent shockwaves through markets, hurting everything from commodities to bonds, stocks and currencies. Strategists are warning a conflict may be one of the biggest threats to markets in 2022, and the tension buildup alone could drag down developing-world bonds in the near term, Morgan Stanley strategists Simon Waever, Pascal Bode, Emma Cerda, Belle Chang wrote in a note Monday.

“For now, we think that investors are at least better off waiting until there are signs of the U.S. Treasury sell-off peaking,” they wrote. “There is a risk that we are trying to be too cute when it comes to timing the bottom, especially given the building negative sentiment on EM and the first Fed hike approaching, which could lead to a turnaround.”

©2022 Bloomberg L.P.