Jun 2, 2023

Traders More Comfortable With a Fed Pause as Key Jobs Data Looms

, Bloomberg News

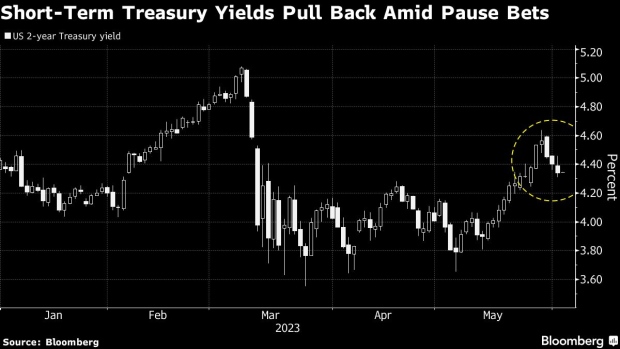

(Bloomberg) -- US interest-rate markets are signaling that the Federal Reserve is more likely to pause on rate hikes than tighten further at its June meeting, ahead of “make or break” data on the state of the US labor market.

With Friday’s non-farm payrolls figures looming, Thursday’s release on private hiring from ADP showed a stronger-than-expected picture, briefly buoying policy-sensitive short-end Treasury yields. That move was quickly reversed, however, as weekly jobless claims data landed largely in line with estimates and the pace of unit labor cost gains in the first quarter was revised lower.

Treasuries extended gains after ISM manufacturing data showed an unexpected drop in prices paid and new orders.

A disappointing jobs figure would likely cement bets on a Fed pause and bolster the bond market further. A stronger-than-expected number would have the opposite effect and reignite the debate on what policymakers will do next.

“Given our expectations for an above-consensus payroll print, we believe the pricing for June could increase once again as economic data remains strong,” wrote TD Securities strategists including Oscar Munoz in a note titled “Make or Break”. “Markets would likely react more to a miss than they would to an upside surprise.”

Swaps indicated around a one-in-three chance of a quarter point Fed hike in June, but a pause is more likely. They show around a four-in-five chance of a hike by July, with one-in-five odds that the tightening cycle is now done entirely. The market pulled back from pricing in higher odds of a June hike Wednesday, helped in large part by commentary from Federal Reserve officials suggesting that a pause is on the table.

Fed Governor Philip Jefferson signaled the central bank is inclined to keep rates steady at its next meeting to give policymakers more time to assess the economic outlook, while Philadelphia Fed President Patrick Harker said he was “definitely in the camp of thinking about skipping any increase” at the June meeting.

“The bar has been raised relative to prior meetings for the Fed to hike rates in June,” said Alan Ruskin, chief international strategist at Deutsche Bank. “Some of that relates to the messaging from Fed officials, the inclination of Harker and Jefferson was to skip in June. The latest signaling suggests you would need to see a very strong payrolls to change the Fed’s mind.”

Aside from the May jobs data due Friday, market pricing for the next steps from the central bank will largely rest with inflation data due June 13, also when the Fed starts this month’s two-day meeting. Until those key reports arrive, the market is vulnerable to repricing a pause in June followed by a quarter-point hike in July.

“The concept of prejudging a skip in June before key May economic data, like NFP, CPI seems odd to us if there is a ‘risk management, data-dependency drive’ at the Fed,” said John Brady, managing director at RJ O’Brien. “July is the better skip.”

--With assistance from Dan Wilchins and Masaki Kondo.

(Updates throughout)

©2023 Bloomberg L.P.