Jan 27, 2022

Traders ramp up bets to see five U.S. Fed hikes this year

, Bloomberg News

Investors startled over U.S. Federal Reserve announcements

Traders are boosting bets for higher borrowing costs, with money markets now expecting five interest-rate increases from the U.S. Federal Reserve this year and another four from the Bank of England.

Investors are also speculating whether Fed Chair Jerome Powell will front-load hikes by making a rare 50 basis-point move in March, after he struck a hawkish tone at this week’s meeting. The wagers rippled through markets, with short-dated bonds slumping and the dollar rallying.

Money markets have priced 30 basis points of Fed tightening in March, which means some see a chance of a larger move than the conventional 25 basis points. By the year-end, traders are factoring in 125 basis points of increases to the Fed funds rate, which is currently in a target range of zero to 0.25 per cent.

“This signals people are getting serious about a 50-basis-point hike,” said Rishi Mishra, an analyst at Futures First.

The tone of Powell’s press conference leaves no doubt that price stability takes precedence over other policy goals, meaning there’s even an upside risk of six hikes, Bloomberg Intelligence’s Anna Wong wrote in a note.

'TOO LOW'

“My biggest disagreement with market pricing though is in the context of a terminal rate in the cycle, where the market discounts rates topping at two per cent,” said Mark Dowding, CIO of BlueBay Asset Management. “I think this is 100 basis points too low and see rates getting to three per cent in 2024.”

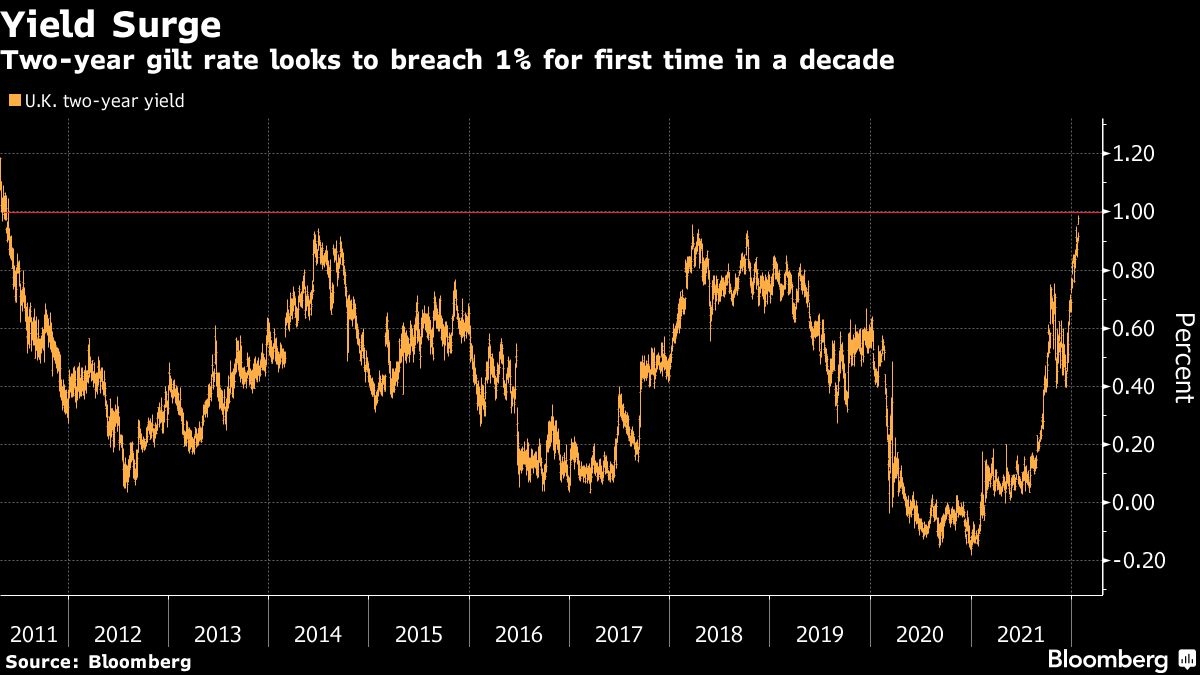

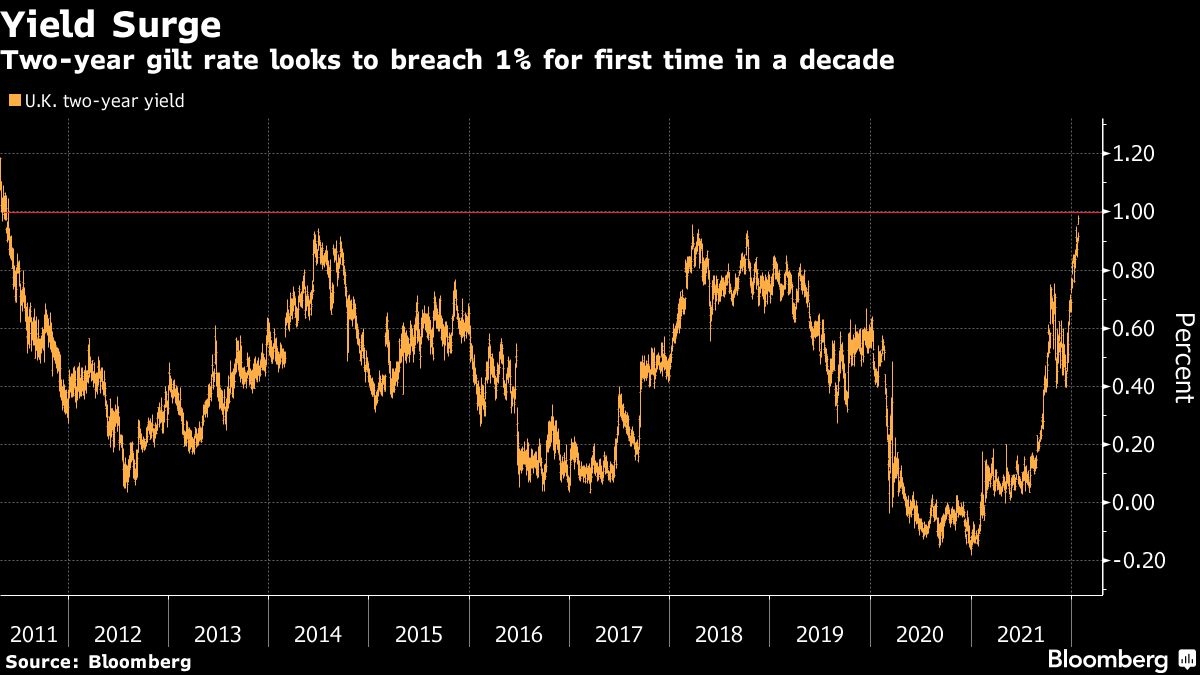

The on-off bets on faster policy tightening in recent months have spurred greater volatility across markets. U.K. bonds took the biggest hit Thursday, with two-year yields climbing to the highest since 2011. The Treasury curve flattened as two-year yields rose three basis points while their 10-year peers fell by just as much.

The rate-hike fever spread in Europe, with traders betting on a 25-basis-point move by the BOE next week to 0.5 per cent. Money markets see the bank rate at one per cent by June and then climbing to almost 1.5 per cent by December. That wasn’t enough to prop up the pound against a resurgent dollar.

The European Central Bank, which has consistently sounded more dovish than its major peers, is now expected to hike its deposit rate by 10 basis points to minus 0.4 per cent by September, from October previously. Policy makers led by Christine Lagarde next meet on Feb. 3.

“It will be really interesting to see if Lagarde will push back on 2022 pricing -- the question is if she can convince markets,” said Piet Christiansen, chief strategist at Danske Bank A/S. “I think she will still say that uncertainty is high and it is highly unlikely to raise rates this year. In this market, it’s not time for high conviction calls on central bank pricing.”