Sep 26, 2022

Traders See Bank of Korea on Track to Another Outsized Rate Hike

, Bloomberg News

(Bloomberg) -- Traders are increasingly confident the Bank of Korea will execute another outsized interest-rate increase soon.

Korea’s implied policy rate in the next three months exceeded 3.2% on Monday, Bloomberg calculations of money market rates showed. That indicates traders are pricing a 50 basis-point hike by the central bank at one of the two remaining meetings this year.

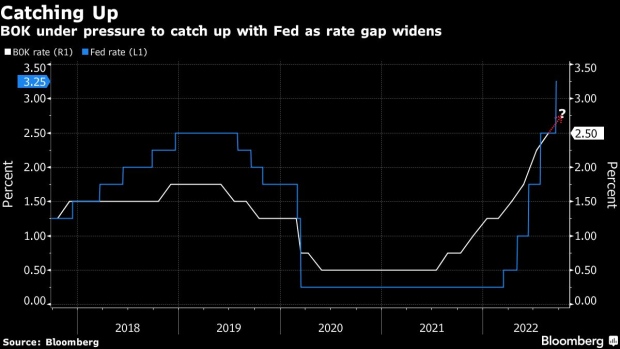

BOK Governor Rhee Chang-yong is keeping the door open for a half percentage-point hike next month after the Federal Reserve raised its key rate by 75 basis points for a third straight meeting. The BOK’s board meets on Oct. 12.

Pressure on the Korean central bank is further building as the won holds above 1,400 per dollar after breaching the key psychological level last week. Citigroup Inc. and JPMorgan Chase & Co. both now forecast a half-point hike by the BOK in October.

The BOK raised rates by 50 basis points for the first time in July. While Rhee said afterward that he preferred a gradual pace of tightening, he kept the door open to a half-point move at Jackson Hole, where Fed Chair Jerome Powell reaffirmed his focus on fighting inflation.

©2022 Bloomberg L.P.