Aug 4, 2021

Traders Seek Bargains in China Stocks That Dodged the Clampdown

, Bloomberg News

(Bloomberg) -- Investors are returning to Chinese stocks after Beijing’s regulatory crackdown triggered last month’s $1 trillion global selloff. But this time they’re placing bets very selectively, in sectors that have found favor with policy makers.

The top two performers on the Hang Seng Index in the first three days of August are BYD Co. Ltd., an electric vehicle maker, and renewable energy products maker Xinyi Solar Holdings Ltd. They’re followed closely by Anta Sports Products Ltd., which has climbed more than 7% back toward a record high.

The national effort to achieve carbon-neutral status and the government’s desire to improve people’s physical fitness has green energy stocks and sports apparel makers looking like smart choices for traders.

The Hang Seng Index and Shanghai Composite Index are among the cheapest markets in Asia, after the recent slump, which was triggered by a move to stop private tutoring companies operating for profit.

“Chinese stock valuations in affected sectors are now priced at a substantial discount relative to history,” JPMorgan Chase & Co. analysts said in a note this week.

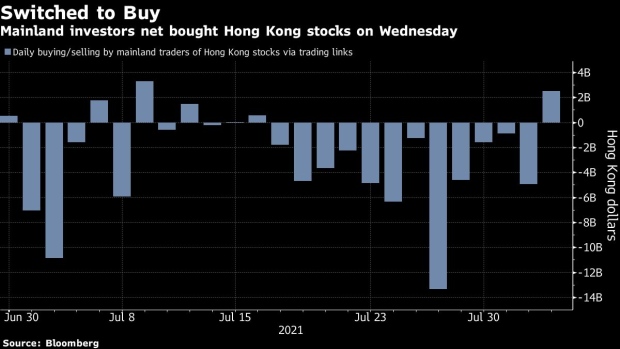

Another positive sign for the market came Wednesday as Chinese investors turned into net buyers of Hong Kong stocks after 12 days of selling.

At the same time, investors are not yet aggressively chasing the stocks hit most during the rout, such as technology firms.

The heavily beaten-down stocks in Hong Kong last week in terms of market value losses -- Tencent Holdings Ltd. and Meituan -- remain some of the biggest decliners on the Hong Kong benchmark this week, Bloomberg data shows. Macau casino shares were also among underperformers after the city reported its first cluster of local cases in over a year.

©2021 Bloomberg L.P.