Jun 13, 2019

Transatlantic Inflation Worries Keep Central Banks in Spotlight

, Bloomberg News

(Bloomberg) -- Go inside the global economy with Stephanie Flanders in her new podcast, Stephanomics. Subscribe via Pocket Cast or iTunes.

Central banks stayed in the spotlight once again this week as more evidence emerged that the holy grail of inflation pressures still isn’t quite within reach.

Here’s our weekly wrap of what’s going on in the world economy.

Counting on Cuts

Looser central bank policy still is very much on investors’ minds, a view encouraged in the U.S. by a report showing core inflation slowed last month. That, along with uncertainty about the broader economic outlook, has fed funds futures indicating two Federal Reserve interest-rate cuts by the end of September. The prospect still hasn’t stopped President Donald Trump and his commerce secretary from continuous attacks on the U.S. central bank for its policy.

Price pressures, or the lack thereof, are also a worry for the European Central Bank. A measure of euro-area inflation expectations slid to a record low this week, while industrial figures showed the economy on a week footing at the start of the quarter. Governing Council member Francois Villeroy de Galhau — a possible successor to Mario Draghi — sees the potential for more stimulus in case of additional euro-area weakness.

Bank of Japan Governor Haruhiko Kuroda also signaled a willingness to act if needed to give inflation another push, but warned of side effects on the financial system. The Swiss National Bank isn’t in the mood to make bankers happy and stuck with an ultra-loose monetary policy setting in its new benchmark rate.

In the U.K., warnings by Bank of England policy makers about the potential for rate hikes are clashing with market predictions for a cut. Further out, the BOE may tilt toward tighter policy should Raghuram Rajan become the next governor early next year.

Despite the global gloom, there were also hawkish noises from Czech central banker Vojtech Benda. He’s got inflation risks on his mind and may even vote this month to hike borrowing costs.

Read more:

- Elusive Inflation in Sweden Is Seen Extending Negative Rate Era

- Don’t Be So Sure the Fed Is Cutting Rates, Say Slok and Hatzius

- S. Africa’s Kganyago Says Model Shows May Be Room for Rate Cuts

Mexico Fallout

Trump may have backed down on a threat to put tariffs on Mexican goods, but his patience depends on a quick drop in migration across the U.S. border — something his own administration and political allies see as an unrealistic expectation.

According to Banxico Deputy Governor Jonathan Heath, that means there’s “almost a permanent threat,” and the central bank can’t start a cycle of easing without clarity. Meanwhile, border towns like Laredo are being whipsawed by the uncertainty, and there’s also Trump’s secret deal that Mexico denies knowing.

Inside China

Trump’s standoff with China is escalating, with the U.S. president first demanding a personal meeting with his Chinese counterpart Xi Jinping at the Group of 20 leaders summit in Japan this month, and then saying he has no deadline to return to trade talks, other than the one in his head. That means Xi has few good options, and China appears to be preparing for the worst, with Bloomberg trade reporter Shawn Donnan’s 10-day tour of the country revealing a nation preparing to ride out a trade war.

The central bank will be there as back up: In a rare interview, People’s Bank of China Governor Yi Gang said there was “tremendous” room to adjust policy, while conceding that tariffs have been a drag on exports and the economy.

Read more:

- China’s Grip on Rare Earths Began With Decision 30 Years Ago

- The U.S. Is Purging Chinese Americans From Top Cancer Research

- How the U.S.-China Trade War Got to This Point: QuickTake

Food Fight

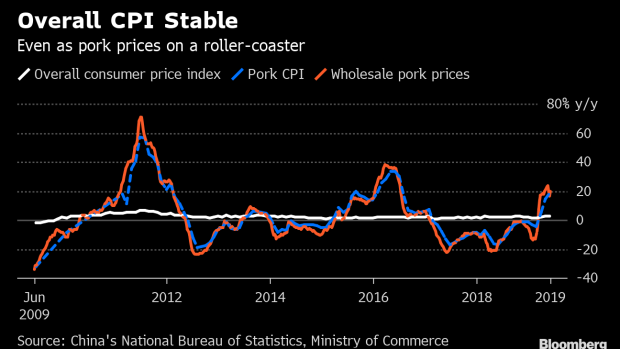

African Swine Fever continues to spread across eastern Asia, driving up pork prices. In China, that surge is having less of an effect on inflation than it once would have, according to research by Bloomberg Economics. Fruit might be the next problem for Chinese consumers.

Pork also in a main component for Czech’s Sunday lunch, and that’s now more expensive than ever before.

Weekend Reading and Listening

- You Have to Spend Money to Make Money. East Africa Believes It

- Europe Better Positioned to Handle Shift to Automation (Stephanomics Podcast)

- Fed Dwarfed by Trump on Twitter as Central Banks Go Social

- How to Freeze Your Salary: Get Pregnant

- Will Woodford Debacle Decide Carney's Replacement?: Mark Gilbert

- What Boy Band Sensation BTS Can Teach Us About Economics

Chart of the Week

China Sets the Pace in Race to Build the Factory of the Future

To contact the author of this story: Zoe Schneeweiss in London at zschneeweiss@bloomberg.net

To contact the editor responsible for this story: Fergal O'Brien at fobrien@bloomberg.net

©2019 Bloomberg L.P.