Sep 6, 2018

Transcontinental profit plunges on costs tied to acquisition, divestitures

The Canadian Press

MONTREAL - Transcontinental Inc.'s (TCLa.TO) stock price fell by five per cent Thursday after the printing, packaging and media company announced third-quarter earnings that were down from last year and well below analyst estimates.

Costs associated with the $1.72-billion acquisition of the Coveris Americas packaging business in May and other transactions pushed down Transcontinental's net earnings to $19.3 million, down 60.6 per cent from $49.0 million in last year's third quarter.

Its adjusted net earnings fell to $52.1 million, down 1.5 per cent from $52.9 million last year, after excluding a number of items related to restructuring and a review of asset values.

The profit amounted to 22 cents per share of net income and 59 cents per share of adjusted earnings.

Analysts had estimated 62 cents of net income and 70 cents per share of adjusted earnings, according to Thomson Reuters Eikon.

Transcontinental stock closed at $29.71, down $1.64 from Wednesday and the lowest close in nearly three months.

Chief executive Francois Olivier told analysts in a conference call after markets closed that he was pleased that Coveris revenue during the quarter was in line with the company's expectations.

However, Olivier said there was room for improvement in terms of both cost-savings and revenue growth as Transcontinental progresses with its integration of Coveris.

“We'll be focusing - among other things - on strengthening the sales force in order to re-ignite sales growth. The process has started and will take several quarters to implement, and so we don't expect this to have any meaningful impact in fiscal 2019,” Olivier said.

Additionally, the Coveris profit margin was below the target range outlined in the acquisition plan because of a delay in its ability to pass through higher materials costs to some customers because of the terms of their contracts, he said.

“That said, our investment thesis remains unchanged,” Olivier said. “Coveris is a significant engine of growth for us and we expect it to be a contributor to our overall profit in the coming quarters.”

“We are well-positioned to begin to realize synergies at the end of the fourth quarter and accelerate them in 2019.”

He said Transcontinental still expects to achieve $20 million of synergies after integrating Coveris.

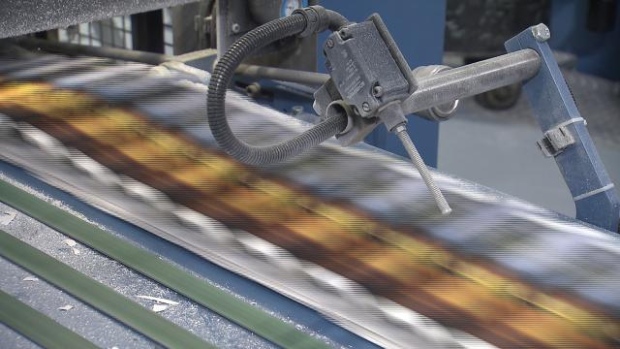

Transcontinental entered the flexible packaging industry several years ago in a bid to diversify from its main printing and media businesses, which have both been affected by a shift away from paper-based publications and advertising.

With the addition of Coveris in a deal valued at US$1.32 billion when it was announced in April, Transcontinental's packaging segment has become the biggest revenue generator for the company.

Coveris Americas has 21 production facilities worldwide and employs more than 3,100 employees, mostly in the Americas.

In Transcontinental's legacy businesses, Olivier said that demand for printing services to retail customers remained relatively stable, although down slightly from a “very solid” result in last year's third quarter. Volume among non-retail printing customers - primarily newspapers - continued to be adversely affected by dwindling advertising.

Transcontinental's media business - which once included daily and community newspapers - has now been refocused on educational and business publications and they performed as planned in the third quarter.