Mar 3, 2022

Treasuries Advance as Ukraine Says Russia Shells Nuclear Plant

, Bloomberg News

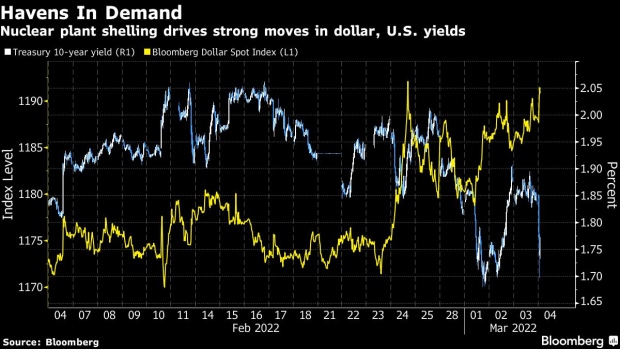

(Bloomberg) -- Treasuries rallied on haven demand after Russian troops shelled Europe’s largest nuclear plant, sending benchmark yields toward their steepest weekly decline since June 2020.

The dollar and yen both strengthened and bonds also advanced in Japan and Australia. U.S. and Europe stock futures declined. Europe’s largest nuclear power plant suffered a fire after the attack, raising concerns over the safety of the facility.

“Markets remain at the mercy of unpredictable Russia/Ukraine headlines, and this latest news regarding the Zaporizhzhia nuclear plant has caused an instant reaction,” said Andrew Ticehurst, a rates strategist at Nomura Inc. in Sydney. “Particularly heading into a weekend, it would seem likely that investors could continue to reduce risk, and the dollar and Treasuries appear to be the safe haven of choice.”

Read More: Europe’s Largest Nuclear Power Plant on Fire as Russia Attacks

U.S. 10-year yields dropped as much as 14 basis points to 1.70%, and they have now slid 19 basis points this week. Australian 10-year yields declined two basis points to 2.14%, while similar-maturity Japanese yields declined 1.5 basis points to 0.155%.

The euro dropped 0.4% to $1.1017 and lost 0.6% to 127.11 yen. S&P 500 futures declined 1.7% and Euro Stoxx 50 contracts slumped as much as 3.1%.

Risk aversion added to the strains apparent in global money markets, with a gauge of banking-sector risk climbing after jumping on Thursday by the most since the 2020 liquidity crisis.

Read More: Funding Stress Indicator Surges to Widest Levels Since May 2020

The FRA/OIS spread -- the gap between interbank rates relative to overnight lending benchmarks -- expanded as much as four basis points to 29.5 basis points, the widest spread since May 2020. A similar gauge in Australia hit levels last seen in April 2020. Japan’s three-month basis swaps dropped below minus 50 basis points for the second time this week as demand for dollar funding hit the priciest levels for yen-based traders since March 2020.

“Risk off is clearly evident and highlights the risk that the market is underestimating Putin’s resolve and level of aggression,” said Rodrigo Catril, a currency strategist National Australia Bank Ltd. in Sydney.

©2022 Bloomberg L.P.