(Bloomberg) -- After the longest advance in Treasuries since April, bond traders banking on even lower yields have some hurdles to clear as the market prepares to absorb $78 billion in new coupon-bearing debt and some key readings on the economy.

A five-week rally has brought benchmark 10-year yields to the brink of the lowest levels in the past six months, and the closely watched 2- to 10-year spread nearer to inversion than it’s been in 11 years. Now traders will look to reports on consumer prices and retail sales to confirm the deepening gloom, after weaker-than-expected U.S. employment data on Friday.

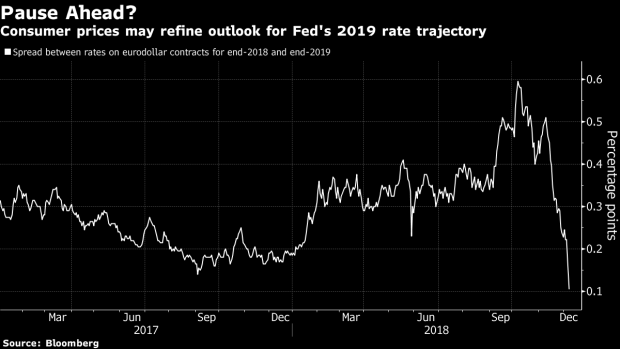

While Federal Reserve Chairman Jerome Powell gave a bullish assessment of the economy last week, the markets are losing confidence that officials will raise interest rates even once in 2019. The swoon in stocks has been a major catalyst for the shift in Fed bets and the downward spiral in yields, leaving trade tensions between the U.S. and China in focus as investors assess the impact on global growth.

“The Treasury market has rallied quite a bit, so to give back some wouldn’t be a surprise especially with supply coming,” said Dan Mulholland, head of Treasury trading at Credit Agricole SA. “We’ve had a massive shift in Fed pricing already as well as some of the larger short Treasury positions covered now.”

The benchmark 10-year yield enters the week at 2.85 percent, after touching 2.82 percent on Dec. 6, its lowest since August. Two-year notes yield 2.71 percent, leaving the gap between the pair at 13 basis points. The spread hasn’t been inverted since 2007.

Short the Front

Even as there are signs of slowing global growth, the Fed is still likely to try and lift rates once next year after doing so in December, BlackRock Inc.’s Rick Rieder said on Bloomberg TV. Fed Governor Lael Brainard said on Friday that U.S. economic momentum is strong and a gradual approach to rate increases remains appropriate for now.

“We are short the front end of the curve,” Rieder said.

Politics and central banks may spur volatility in debt markets this week. The U.K. Parliament is scheduled to vote on Prime Minister Theresa May’s Brexit deal, amid predictions she may not win approval of her divorce agreement with the European Union. Thursday, the European Central Bank meets, with economists expecting officials to lower their growth forecasts yet still strike an assured tone.

The flattening of the curve last week, with one section inverting for the first time in more than a decade, also has traders monitoring whether the phenomenon becomes more pervasive.

The spread between 3- and 5-year, as well as 2- to 5-year yields both fell below zero, although the 2- to 10-year gap is more closely watched as a potential recession indicator.

“While the inversion of the 2s5s curve is a concern, economic fundamentals remain strong,” Societe Generale strategists including Subadra Rajappa wrote in a note.

What to Watch This Week

- There are no Fed speakers as officials enter the standard quiet period before their Dec. 19 decision

- For economic releases, consumer prices and retail sales take center stage

- Dec. 10: JOLTS job openings; ISM semi-annual economic forecast

- Dec. 11: NFIB small-business optimism; producer prices

- Dec. 12: MBA mortgage applications; consumer prices; monthly budget statement

- Dec. 13: Import/export prices; initial jobless claims; Bloomberg U.S. economic survey; Bloomberg consumer comfort

- Dec. 14: Retail sales; industrial production; manufacturing production; Markit manufacturing and services PMI; business inventories

- The Treasury will auction bills, notes and bonds:

- Dec. 10 brings $39 billion of three-month bills and $36 billion of six-month bills, with sales of 4- and 8-week bills slotted for Dec. 13

- Treasury sells $38 billion of three-year notes on Dec. 11, $24 billion of 10-year notes on Dec. 12 and $16 billion of 30-year bonds Dec. 13

To contact the reporter on this story: Liz Capo McCormick in New York at emccormick7@bloomberg.net

To contact the editors responsible for this story: Benjamin Purvis at bpurvis@bloomberg.net, Mark Tannenbaum, Boris Korby

©2018 Bloomberg L.P.