Sep 24, 2019

Treasury’s Long-Awaited Data Release Falls Flat

, Bloomberg News

(Bloomberg Opinion) -- The defining moment of the 2019 U.S. Treasury Market Conference on Monday was supposed to be a big government announcement: After years of internal debate, the Treasury Department had finally decided to recommend publicly releasing data on trading volume in the world’s biggest bond market.

Instead, judging by the audience’s reaction, it was upstaged by a bond-market joke from Scott Minerd at Guggenheim Partners. That ought to be telling about how little the Treasury’s plan improves transparency.

Just before the group of Wall Street dealers, central bankers and regulators adjourned for lunch, Deputy Treasury Secretary Justin Muzinich said in a speech that the department was advising that the Financial Industry Regulatory Authority release weekly aggregate volume statistics in the Treasury market, with the first publication coming early next year. Finra has been collecting transaction data since 2017. Before the conference, a Treasury official disclosed to Bloomberg News’s Liz Capo McCormick that the U.S. government would disclose its plan, presumably as a way to catch the market’s attention.

In my conversations at the conference, held at the Federal Reserve Bank of New York, the general feeling was that releasing somewhat stale numbers on trading volume, absent any pricing data, provides little insight into the $16 trillion Treasuries market. My Bloomberg News colleagues heard similar sentiments: “It is only a small iteration from where we are today. … The additional transparency I think will be welcomed by most, but many market participants were left wanting more,” said Kevin McPartland, head of market structure and technology research at Greenwich Associates.

The reason for such a small step appears to be the “do no harm” principle outlined by Treasury Secretary Steven Mnuchin at the same conference in 2017. As Muzinich explained:

“The typical motivation for making transaction data public in other fixed income securities has been the need for greater price transparency. However, based both on the feedback from market participants, and on the observation that Treasury securities already trade with very tight bid-offer spreads, price transparency largely exists in the Treasury market. It should therefore not be the sole basis for releasing transaction data.”

...

“The release of aggregate market volumes will be consistent with one of our key principles, in that it should have no negative impact on market behavior or liquidity. In fact, Treasury believes that a better understanding of how much volume is passing through the market, particularly in off-the-runs, should encourage even greater interest in those securities.”

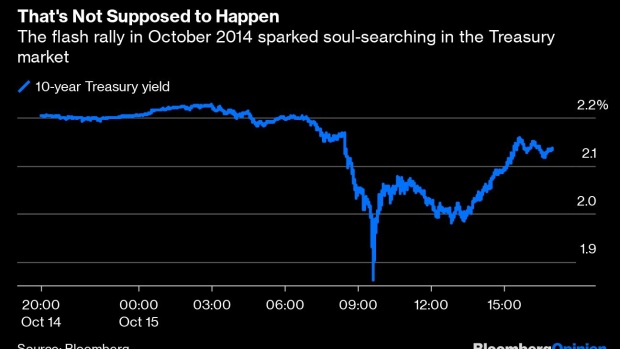

I think most in the audience would agree that releasing this data publicly will have no negative impact. But that has more to do with the expectation that it won’t have any effect whatsoever. It sounds as if Treasury officials and those market participants they spoke with think everything is working just fine. That’s quite the conclusion to reveal at a conference that was organized in large part as response to the flash rally in Treasuries on Oct. 15, 2014. As a reminder, 10-year yields plunged as much as 34 basis points that day — a move so extreme it should occur only about once every 4,800 years.

This strikes at the heart of a frequent debate within the bond markets — what is the right level of transparency for trading securities that are far less homogenized than equities? Earlier this year, Finra proposed a pilot program that would give bond traders 48 hours before having to disclose large block trades to other investors, rather than the 15 minutes required under current rules. As is, dealers have a significant disincentive to take down large chunks of corporate bonds because every other trader will know the specifics of their purchase within minutes and use that knowledge against them when transacting.

The tug of war was made clear in a later panel about the future of Treasury market structure. Howard Lutnick, chairman and CEO of Cantor Fitzgerald, argued that “we are a professional market, a grown-up market, an institutional market.” And for that reason, the relationship-based nature of bond trading wouldn’t be going away soon. Paul Hamill of Citadel Securities advocated for innovation. Minerd, before cracking his joke about Treasury traders, bemoaned the “archaic method” of calling three dealers to obtain a price for a bond. “It’s a low-value add. We’re not curing cancer, we’re getting a quote on a bond.”

And yet, perhaps the one important takeaway from the Treasury’s trading volume data is that, in the words of Bloomberg News’s Elizabeth Stanton, banks still call the shots. High-frequency traders bought and sold only about $140 billion of Treasuries a day since April, or 20% of total volume. They account for 60% of trading on electronic venues. While that’s a sizable share, it’s a far cry from the algorithmic takeover that some analysts saw as inevitable, particularly after the flash rally.

Apparently, Treasury hasn’t closed the door on releasing trade price details to the public later. An official told Bloomberg News that the debt-management team is continuing efforts with Finra but hasn’t committed to eventually disclosing pricing. If it took this long just to get weekly trading volume out in the open, traders can probably safely assume price data won’t reach the public anytime soon.

To contact the author of this story: Brian Chappatta at bchappatta1@bloomberg.net

To contact the editor responsible for this story: Daniel Niemi at dniemi1@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Brian Chappatta is a Bloomberg Opinion columnist covering debt markets. He previously covered bonds for Bloomberg News. He is also a CFA charterholder.

©2019 Bloomberg L.P.