Sep 27, 2021

Treasury Two-Year Yield Jumps to 18-Month High After Auction

, Bloomberg News

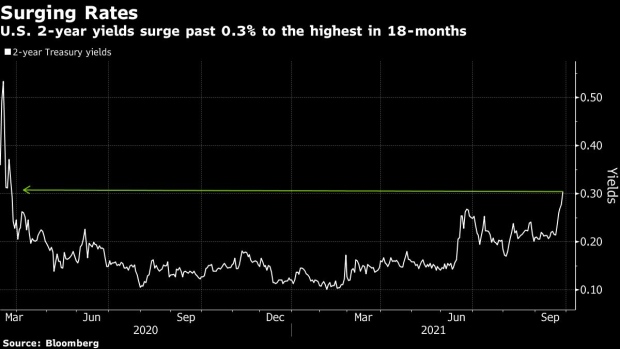

(Bloomberg) -- The Treasury two-year yield jumped to its highest since March 2020 amid a benchmark switch and ongoing prospects for Federal Reserve tapering.

The yield rose three basis points to 0.31% on Tuesday. Traders attributed the opening jump to the rollover in the benchmark note following Monday’s auction which saw soft demand, with primary dealers being awarded the highest amount of notes since April.

U.S. yields have been on the rise after the Fed signaled last week that the tapering of asset purchases may begin in November. The bonds are also weighed by hawkish signals from other developed-market central banks including the U.K. and Norway.

“Dollar rates are waking from their summer doldrums,” said Eugene Leow, rates strategist at DBS Bank Ltd. in Singapore. “They are more reflective of fundamentals now, paring the excessive pessimism on the economy. I do see further upward pressures on U.S. yields, but perhaps at a more moderate pace.”

The compressed schedule of this week’s U.S. debt auctions could also be providing an additional catalyst for higher yields. The week’s supply concludes with a $62 billion sale of seven-year notes on Tuesday, following two- and five-year auctions Monday.

©2021 Bloomberg L.P.