Mar 20, 2019

Treasury Yields Fall to Lowest in More Than a Year

, Bloomberg News

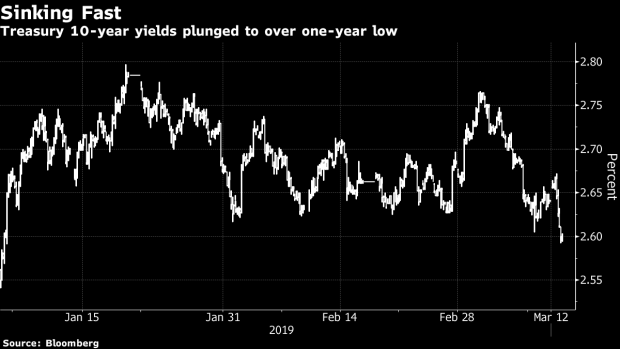

(Bloomberg) -- Treasuries surged, driving 10-year yields to the lowest level since January 2018, as Federal Reserve officials wiped out interest-rate hikes from their median projection for this year and said they’d stop shrinking the central bank’s balance sheet in about six months.

The 10-year Treasury yield slid as low as 2.53 percent Wednesday, about 9 basis points below Tuesday’s close. Meanwhile, the spread between 5- and 30-year yields -- one of the most closely watched parts of the curve -- touched 66 basis points, the widest in more than a year, as futures traders now see about a 50 percent chance of a quarter-point rate cut this year.

Officials’ projection of zero rate increases this year compares with the median estimate of two 2019 hikes given in December. On its balance sheet, the Federal Open Market Committee said it intends to halt the reduction of its debt holdings at the end of September.

“This was a bit of a surprise, as the Fed took out its entire rate-hikes plans for this year and ended the balance sheet roll-off a bit earlier than expected,” said Ben Emons, managing director of global macro strategy at Medley Global Advisors in New York.

To contact the reporter on this story: Liz Capo McCormick in New York at emccormick7@bloomberg.net

To contact the editors responsible for this story: Benjamin Purvis at bpurvis@bloomberg.net, Mark Tannenbaum, Nick Baker

©2019 Bloomberg L.P.