Nov 28, 2021

Treasury Yields Rebound After Friday’s Variant-Driven Collapse

, Bloomberg News

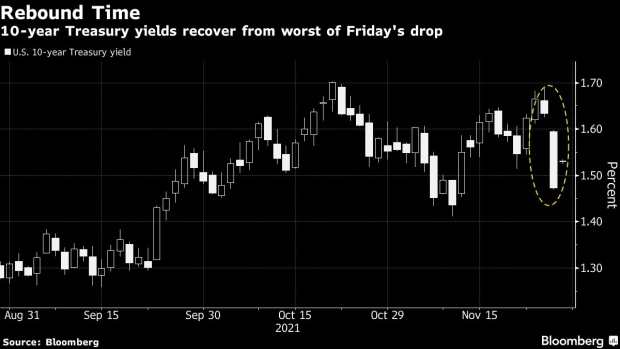

(Bloomberg) -- Treasury yields climbed across the curve Monday as traders deemed Friday’s tumble went too far, considering the latest newsflow on the omicron variant.

The benchmark 10-year note dropped, sending yields up as much as 6 basis points to 1.54%. That unwound some of Friday’s 16 basis point plunge -- the steepest drop since March 2020. Five-year yields rose as much as 7 basis points to 1.23%, shrinking the gap with 30-year notes by 2 basis points.

South African health experts, including the doctor who first sounded the alarm about the omicron variant, indicated that symptoms linked to the coronavirus strain have been mild so far. Still, the World Health Organization urged caution.

U.S. equity futures rebounded with crude oil, though traders retained their slightly diminished expectations for Federal Reserve tightening as the mutation spurs uncertainty about the economic outlook. Markets now expect the first rate hike in July next year, compared with last Wednesday’s pricing which saw traders plump for June.

The increase in yields helped push the dollar higher against the yen, euro and Swiss franc. The Australian dollar led commodity currencies higher against the greenback.

©2021 Bloomberg L.P.