Feb 28, 2021

Troublesome Trio in Emerging Markets Face Yield-Spike Scare

, Bloomberg News

(Bloomberg) -- Eight years ago, when the taper tantrum roiled emerging markets, the so-called Fragile Five of Turkey, Brazil, South Africa, India and Indonesia suffered the most. Today, another sharp spike in U.S. Treasury yields threatens to wreak havoc on at least three of those nations.

The Turkish lira, Brazilian real and South African rand led major global declines last week in the worst developing-nation currency selloff since late September. Those exchange rates have the highest one-week implied volatility in the world, with some analysts warning of more pain ahead.

Benchmark 10-year Treasury yields surged last week to the highest in more than a year, leading traders to yank forward their expectations on how soon the Federal Reserve will be forced to tighten policy. For now, officials are stressing that the central bank has no plans to raise rates given lingering weakness in the labor market. That will make Fed Chairman Jerome Powell’s comments on Thursday at a Wall Street Journal event all the more interesting.

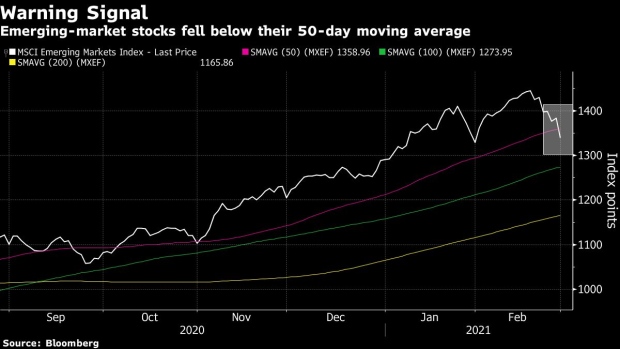

In the developing world, dollar-denominated and local bonds just endured their worst month since last March, while stocks posted their biggest weekly decline in almost a year. MSCI Inc.’s emerging-market equity index slid beneath its 50-day moving average, suggesting the possibility of additional weakness ahead. Meantime, a JPMorgan Chase & Co. gauge tracking volatility in developing-nation assets soared last week by the most since early August.

“In the absence of a more concerted effort to slow the spike in yields, emerging markets may remain under pressure,” said Ilya Gofshteyn, a senior strategist at Standard Chartered in New York. “Higher-yielding currencies will continue to be particularly adversely affected and duration across emerging markets is also likely to remain especially vulnerable.”

OPEC+ will meet on Thursday, setting the stage for another potential conflict between Russia and Saudi Arabia after last year’s oil-price war. The same day, Malaysian policy makers are expected to keep borrowing costs at a record low of 1.75%. Elsewhere, Turkey may report rising inflation, while purchasing managers’ index figures offer health checks in South Korea and Russia.

What to Watch

- China’s National People’s Congress will hold its annual session on March 5, featuring President Xi Jinping and other top leaders. This year’s gathering marks the 100th anniversary of the founding of the Communist Party of China. The event may last shorter than the regular two weeks because of the pandemic

- The proposed agenda includes an examination of the economy and the 14th five-year plan, Xinhua reported

- The Chinese People’s Political Consultative Conference, an advisory body whose annual meeting is held in conjunction with the NPC, will gather on March 4, according to Xinhua

- The meetings probably won’t set a GDP growth target but will emphasize “high-quality” growth considering Covid-19 is still widespread outside China, Iris Pang, an economist at ING in Hong Kong, wrote in a note

- Policy actions will also include a road map on how to reach carbon neutrality by 2060 as well as a resumption of de-leveraging reform, she said

- The yuan has the second-best currency return in emerging markets this year

- U.S.-Saudi relations will be monitored after an American intelligence report implicated Saudi Arabia’s Crown Prince Mohammed bin Salman in approving the killing of Washington Post columnist Jamal Khashoggi, an act President Joe Biden called “outrageous”

Nigeria’s central bank governor suggested the currency was devalued

- Governor Godwin Emefiele said the official exchange rate now stands at 410 to the dollar. That’s 7.6% weaker than the rate of 379 published on the central bank’s website

- Brazilian lawmakers are slated to pick up the debate around emergency cash handouts

- The real is the worst-performing currency in Latin America this year to date

- READ: New Covid Aid Will Loosen Brazil’s Key Fiscal Rules In 2021

Bank Negara Malaysia:

- Malaysia’s central bank may keep its overnight policy rate at a record low 1.75% on Thursday. Traders are reducing bets on further easing amid a surge in global bond yields

- “Stringent social containment measures have dented Malaysia’s growth recovery trajectory,” Kanika Bhatnagar, an economist at Australia & New Zealand Banking Group Ltd. in Bangalore, wrote in a client note. “Monetary policy will remain accommodative, with the central bank continuing with its purchases of government bonds and carrying out reverse repo operations”

- Malaysia’s ringgit has weakened 0.7% this year amid an extended lockdown and a delay in vaccine rollouts. At the same time, rising oil prices are starting to improve the outlook for the currency for emerging Asia’s only exporter of the commodity

Key Data

- China’s manufacturing activity dropped further in February as the Lunar New Year holidays disrupted production, while travel restrictions to contain virus outbreaks cut spending on services. This will be followed by factory gauges from Malaysia, Indonesia, Thailand, Philippines and India on Monday, along with a Caixin gauge for China. South Korea and Taiwan will report similar data Tuesday

- China’s factory activity will be watched after the PMI gauge fell in January

- South Korea will report February trade figures Monday, with exports probably rising for a fourth month. January industrial-production numbers are due Tuesday, and final fourth-quarter GDP figures are scheduled for Thursday

- The won has lost 3.3% this year

- CPI data for February will come from Indonesia on Monday, South Korea on Thursday, and the Philippines and Thailand on Friday

- Philippine real yields turned negative in January after CPI rose to the highest level in two years

- South Korea will post foreign reserves data Thursday, followed by Indonesia, Malaysia, Taiwan, Thailand and the Philippines on Friday

- Turkey’s $736 billion economy topped major competitors in the final quarter, as rate cuts and a spending-and-credit binge beat back virus restrictions even as the lira sank, data will likely show Monday

- The lira trimmed its gains to 0.2% after being the best performing currency this year

- READ: Policy Jitters Compound Lira’s Worst Week Since 2018 Crisis

- READ: Pandemic Binge Likely Spurred Turkey to Top of Growth League

- Russia’s purchasing managers’ index, published Monday, is set to pick up in February compared with a year ago

A reading of Brazil’s GDP on Wednesday will probably show strong levels of growth in the final three months of 2020 as Latin America’s biggest economy recovered from the shock of Covid-19

- Traders will also monitor January industrial production figures, to be released on Friday, for signs of a comeback

- In Mexico, the central bank will probably raise its GDP growth forecasts for this year and next when it publishes its quarterly inflation report on Wednesday, according to Bloomberg Economics

Colombia’s February consumer price inflation figures are expected to show a contraction from a year earlier amid weak domestic demand

- The results may have an impact on investor expectations for the central bank to remain accommodative

While traders may see evidence of a recovery in Chile’s January economic activity data, to be released on Monday, Bloomberg Economics expects the gauge to linger below its pre-pandemic levels

- A reading of confidence will also be watched for signs of a comeback as vaccines are rolled out

©2021 Bloomberg L.P.