Mar 19, 2019

Morneau's pre-election budget includes something for (almost) everyone

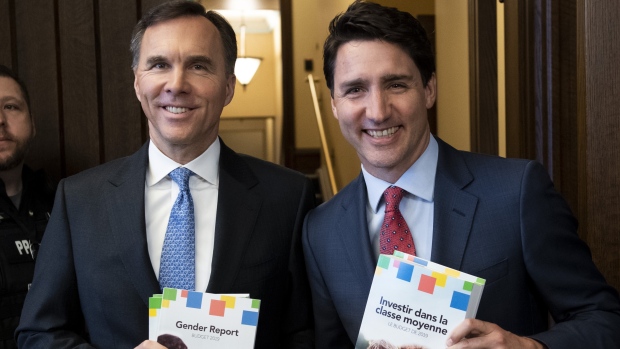

By Greg Bonnell

It’s an election-year budget and the Liberals want to make sure the average Canadian feels included in the plan, so raise your hand if you fall into one of the following groups:

- First-time homebuyers struggling to get into the market

- Students struggling with debt

- Working Canadians feeling insecure about technological change

- Retirees worried about pensions and making ends meet

- Anyone struggling with high prescription drug costs

It turns out the budget has something, or the promise of something, for all of you as Finance Minister Bill Morneau lays out the fiscal blueprint the Liberals hope will lead them to another mandate.

However, the budget tabled Tuesday does not include a roadmap back to balance – rather a pledge to take the deficit down from $19.8 billion in 2019-20 to a $9.8-billion shortfall by spring 2024.

And if you’re a business leader looking for fresh measures to address competitiveness or supports for the hard-hit energy industry, this is not the budget for you.

WEIGH IN

Are you more confident in Canada’s economy after the budget?

On the contentious housing file, the budget proposes a new First-Time Home Buyer Incentive. Simply put, Canada Mortgage and Housing Corporation will contribute to an eligible first-time buyer’s down payment in what’s called a shared equity mortgage.

For example, if you’re buying a new condo for $400,000 and you’ve scrounged up a $20,000 down payment (which is five per cent of the purchase price), the CMHC will kick another $40,000. That brings down your overall mortgage amount and, hence, your monthly payments.

In that example provided in the budget, the homebuyer would save $228 per month – or $2,736 a year – on mortgage payments.

It’s a means-tested program, so only first-time buyers with a household income under $120,000 annually need apply. And CMHC will want its money back when you sell the home.

The incentive is sweeter if you buy a newly-constructed home (10 per cent of the purchase price), as opposed to an existing home (five per cent). The Liberals hope that will encourage new home construction to address supply shortages.

CMHC would provide $1.25 billion over three years, starting this September, to eligible homebuyers.

The RRSP Home Buyers’ Plan, which allows first-time buyers to withdraw funds from their RRSP tax-free to fund a home purchase, is getting updated. The budget proposes to raise the withdrawal limit to $35,000 from the current $25,000.

When it comes to student debt, Morneau says the 99 per cent of student borrowers who have a floating rate on their Canada Student Loans will see their interest rate lowered to the prime lending rate – currently 3.95 per cent at the big banks.

If technology has you “anxious about the changing world or work,” there’s a new Canada Training Benefit proposed in the budget. The aim is to help pay for job training, provide income support during that training, and offer job protection so workers can take time off to get that training.

Part of the program is a Canada Training Credit, which would see eligible workers between the ages of 25 and 64 accumulate a $250 per year credit balance, up to a lifetime limit of $5,000.

Once you reach retirement, the budget is vowing to better protect pensions “challenged due to company bankruptcies” by making insolvency proceedings fairer, setting higher expectations for corporate behavior, and clarifying pension-benefit rights in federal pension law.

Low-income seniors who are still working would see an enhanced Guaranteed Income Supplement earnings exemption, increasing the full exemption from $3,500 to $5,000 annually.

When it comes to soaring drug costs, the Liberals pledge to create a Canadian Drug Agency aimed at bringing down prices through its bulk buying power. That, Morneau says, will “pave the way for national pharamacare tomorrow.”

In short, the Liberals say they’ll pursue national pharamacare coverage for all Canadians – but the details are to come.