Apr 10, 2023

Trudeau’s crude pipeline set to provide boost for Canadian oil

, Bloomberg News

Dawn Farrell to head Trans Mountain

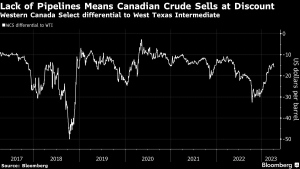

Canadian oil producers beset by years of constrained pipeline capacity expect to garner better prices for their crude when the expanded Trans Mountain conduit starts up next year, opening them to new markets in Asia.

The expansion project — which Prime Minister Justin Trudeau’s government bought for $4.5 billion in 2018 — will reduce oil-sands producers’ dependence on U.S. refiners that currently forces them to accept discounted prices for their crude. Coming a little more than two years after the 2021 startup of Enbridge Inc.’s Line 3, the Trans Mountain expansion has — at least temporarily — removed pipelines from the list of concerns for an industry long hampered by limited shipping options.

“Being able to send our barrels into more markets is a big opportunity for Canada,” Canadian Natural Resources Ltd. Chief Financial Officer Mark Stainthorpe said at the Bank of Montreal-Canadian Association of Petroleum Producers conference last week.

CNRL, the country’s largest oil producer, will ship 94,000 barrels a day on the expanded Trans Mountain when it begins operating in the first quarter, accounting for about 16 per cent of the total space available on the line. The company is looking at Asian and US West Coast markets for that crude, Stainthorpe said.

The pipeline also may allow oil-sands companies to boost production. Imperial Oil Ltd., which is controlled by Exxon Mobil Corp., expects to finish a 15,000-barrel-a-day expansion of its Cold Lake facility ahead of schedule this year, Chief Executive Officer Brad Corson said at the conference. The company also is considering restarting paused expansion projects in the area as pipeline constraints ease.

The Trans Mountain expansion will more than double the capacity of the existing line to 890,000 barrels a day. Costs for the project — which runs from Edmonton to shipping terminals near Vancouver — have ballooned more than fivefold to $30.9 billion from an initial estimate of $5.4 billion.

The project also will benefit producers that don’t ship on the line, said Crescent Point Energy Corp. CEO Craig Bryksa.

“Volumes are going to shift to that, and they’re going to create a little bit of capacity on the other existing infrastructure, which ideally helps our differentials in Western Canada,” Bryksa said in an interview. “So I see it as a big win for the basin over time.”

One company that’s not expected to benefit from the startup is Enbridge Inc., which operates competing crude pipelines out of Alberta. Chief Executive Officer Greg Ebel said the company is talking with the shippers on its Mainline system about the options it can offer them, including opportunities to boost capacity and the potential for new storage on the US Gulf Coast.

“Customers recognize something like TMX would be very difficult to expand,” Ebel said in an interview. “The Mainline has additional opportunities for expansion over time, has different elements and obviously touches a lot more markets.”

More broadly, the Trans Mountain startup takes pipelines out of the menu of major concerns for the time being and allows producers to think about new ways to improve their business, Canadian Association of Petroleum Producers President Lisa Baiton said in an interview.

“Egress has always been a challenge for Canada,” she said in an interview. “But people are moving away from broad-based discussions about egress challenges and being more thoughtful and strategic on how can we make Canada’s products competitive.”