May 29, 2020

Trump Action Aside, China Crop-Buying Goal Is Becoming Untenable

, Bloomberg News

(Bloomberg) -- President Donald Trump is preparing to announce actions on China. Whether or not that affects his phase-one trade deal, one thing is already clear: the target for agricultural purchases is becoming untenable.

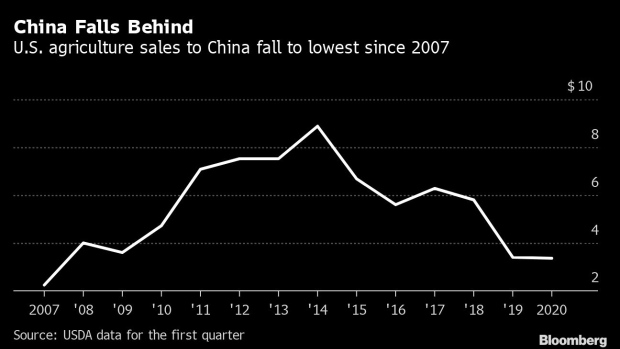

China bought just $3.35 billion in American agricultural products in the first three months of the year, the lowest for that period since 2007, according to data from the U.S. Department of Agriculture. That’s a fraction of the $36.5 billion it promised for 2020 under the partial trade deal reached in January.

The spread of the novel coronavirus has put China well behind the necessary pace to meet its phase one pledges. And while purchases of everything from pork to soybeans have picked up in the past two months, it’s “highly unlikely” the nation will reach the target given low commodity prices, according to Rabobank, one of the largest lenders to the agriculture industry.

“The commitments are not in volume, they’re in dollar value,” Stephen Nicholson, a senior analyst for grains and oilseeds at the Dutch bank, said in a telephone interview. “When commodities are so cheap, you can buy a lot and not get close to that number. That’s the concern.”

Trump said he will announce new policies on China Friday. The president wasn’t specific, but he was responding to a question about whether the U.S. would remain in the “phase one” deal. Larry Kudlow, director of the National Economic Council, said earlier that the deal remains in place for the moment but added that China’s moves on Hong Kong were “a very, very big mistake.”

Tensions between the U.S. and China have been escalating recently, with Trump blaming the Asian nation for misleading the world about the scale and risk of the coronavirus outbreak. On Wednesday, the U.S. said it could no longer certify Hong Kong’s political autonomy from China, sparking fears of trade disruptions.

Since the coronavirus shut down China and disrupted imports, traders have speculated the Asian nation, the top consumer of pork and soybeans, would invoke a clause that could potentially allow it to renegotiate the trade deal. That hasn’t happened and despite the worsening rhetoric on the U.S. side, China has made progress in its purchases recently.

“I think China will ignore the rhetoric to a point but will respond to any actions or sanctions against China’s interest,” said Dan Kowalski, vice president of research at CoBank, a $145 billion lender to the agriculture industry. “I’m encouraged by the direction and the momentum they have brought into this in the last couple of months.”

Slow Chinese buying in the U.S. also has been helped by a weaker currency in rival Brazil, which has made the nation’s commodities more attractive. China tends to buy where it’s cheaper and the deal acknowledges purchases will be made at market prices.

“China has offered the import opportunities and if market conditions are good, China can import more,” Cheng Guoqiang, a China farm trade expert and a professor at the School of Economics and Management of Tongji University, told a conference this month. “You can not ask commercial soy plants to increase imports of U.S. soybean that are 10% or 20% more expensive than Brazilian soybeans.”

There’s also the issue of data. While USDA figures show sales of $3.35 billion in the first quarter, Chinese customs data indicate $5.1 billion, according to Bloomberg calculations. For April, Chinese data point to another $1.25 billion while the U.S. still hasn’t made its figures available.

China usually loads up on American agricultural commodities in the first and fourth quarters. With the U.S. figure being so low in the first three months of the year, that will probably leave more than $20 billion to be picked up from October to December, Rabobank’s Nicholson said. There’s also concern the nations may decide to tear up the deal.

“Will they go and tear ‘phase one’ up? Maybe. Will it be renegotiated? Maybe. Who knows what could happen,” Nicholson said. “I think the talks will continue, because it’s mutually beneficial.”

©2020 Bloomberg L.P.