Aug 25, 2019

Trump’s Trade Shocks Risk Recession Central Banks Can’t Prevent

, Bloomberg News

(Bloomberg) -- Central bankers attending the Federal Reserve’s annual Jackson Hole symposium encountered lengthy delays in checking into the mountain resort on Thursday before the conference’s start. The reason: the hotel’s computer system wasn’t working.

It was a telling metaphor for the position that the world’s monetary policy makers find themselves in as they try to reboot the global economy amid increasing doubts over their ability to do so.

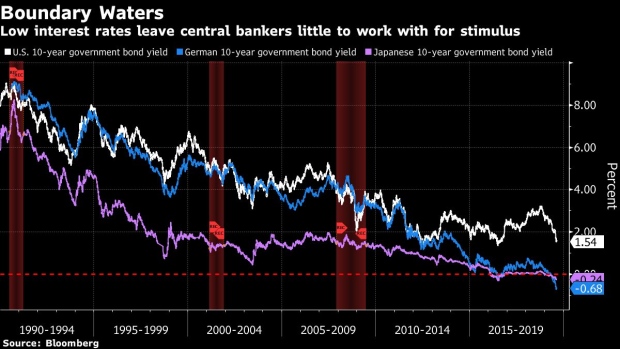

Not only are they saddled with interest rates that are already super low, they’re also confronting a mounting deglobalization shock of uncertain proportions triggered by President Donald Trump’s trade policies.

There is “a growing risk of a global liquidity trap” in which easier monetary policy fails to offset shocks to demand, Bank of England Governor Mark Carney told the Kansas City Fed-sponsored symposium on Friday.

There’s a lot at stake. The risk of a global recession has ratcheted higher as the U.S.-China trade confrontation escalated to a potentially irreversible level with Trump’s announcement on Friday of a wave of higher tariffs on Chinese imports.

The Fed, the European Central Bank and the Bank of Japan will all ease policy next month in response, along with a number of other central banks, according to JPMorgan Chase & Co. Chief Economist Bruce Kasman and his team. But those “actions will likely be of limited value if growth momentum falters badly,” they wrote in an Aug. 23 report.

“Central bank interest rates are low all over the place, which means if you find yourself in a position where you need to cut, you don’t have much you can do,” former Fed Vice Chairman and Jackson Hole attendee Alan Blinder said in an interview. “In Europe, interest rates are negative. In Japan, interest rates are negative.”

That’s led to calls for fiscal policy makers to fill in the gap with stimulus measures of their own, such as increased government spending.

It’s also spawned suggestions of greater policy coordination, both internationally among major countries, and nationally between governments and their independent central banks.

That’s unlikely to happen while Trump is in charge. He’s alienated U.S. allies by threatening to slap tariffs on imports of Japanese and European cars, though he said Sunday at the Group of Seven summit in Biarritz, France, that Japan and the U.S. had reached a trade agreement in principle.

Trump also vociferously attacked the Fed again on Friday, going so far as to ask whether chairman Jerome Powell was a bigger enemy than Chinese President Xi Jinping shortly after the central bank chief spoke to the Jackson Hole symposium. Treasury Secretary Steven Mnuchin told “Fox News Sunday ” that the president’s tweeted comment shouldn’t be taken literally.

“The big policy uncertainty now, of course, is Trump. It’s obvious,” said economist Gauti Eggertsson. The Brown University professor suggested central bankers at this year’s confab were short of ideas about how to cope with a possible downturn in the current low-rate environment, and more than a little distracted by what might come next from the U.S. president -- always just one tweet away.

“When Powell was giving his speech, I could see everybody on their iPhones, refreshing Twitter, waiting for the tweet from Trump,” said Eggertsson, a former New York Fed economist.. “The most powerful central bankers in the world, all in the same room, would -- rather than listen to Powell, they’re checking on Twitter waiting for when Trump is going to tweet.”

Powell steered clear of commenting on Trump in his speech at Jackson Hole. But former Fed Vice Chairman Stanley Fischer was not as reticent.

“The trouble one has is not in” the international monetary system, Fischer, widely seen as the doyen of the central banking community, told the symposium. “It is in the president of the United States. We are in a system in which things are getting worse day by day.”

Powell did, though, use his appearance at Jackson Hole to lay out the damage that heightened trade tensions are having on the U.S. and the global economies, and the challenge that the Fed has in dealing with them.

There are “no recent precedents to guide any policy response to the current situation,” he said. “While monetary policy is a powerful tool that works to support consumer spending, business investment and public confidence, it cannot provide a settled rule book for international trade.”

Powell declared that the U.S. economy was in a “favorable place,” but nevertheless suggested that the Fed was ready to cut rates when it meets Sept. 17-18.

The risk is that rapidly-evolving political uncertainties surrounding trade will mean that the Fed will be slow to respond and thus not fully insulate the economy from the fallout, said conference attendee and BNY Mellon chief economist Vincent Reinhart.

“The fulcrum or center of gravity of the U.S. economic policy today is not monetary policy, it is trade uncertainty,” Dallas Fed President Robert Kaplan told Bloomberg Television on Friday at Jackson Hole. “If we have a severe slowdown, I don’t think monetary policy is going to be enough to arrest it.”

ECB, BoJ to Ease

The ECB is already facing a slump in Europe’s biggest economy, Germany, which slipped into contraction last quarter. Central bank officials have said they’re planning an additional round of stimulus, with investors expecting an interest-rate cut and the potential restart of bond purchases.

Blinder, now a Princeton University professor, questioned how much further the ECB could reduce rates into negative territory and wondered how much impact bond buys would have, given the low level of European yields.

In Japan, the BOJ may have to “reluctantly” reduce its negative rates even further next month if the yen strengthens too much, said former board member Sayuri Shirai.

“A major concern for the central bank in Japan is the exchange rate,” Shirai, now a visiting researcher at the Asian Development Bank Institute, told Bloomberg Television on Aug. 22.

Policy Challenges

While many fretted, conference attendee and former Bank of England policy maker Kristin Forbes suggested that the pessimism about how much central banks can achieve may be overdone.

“We’re certainly not out of ammunition,” Forbes, now a professor at the Massachusetts Institute of Technology, said in an interview.

But Reserve Bank of Australia Governor Philip Lowe cautioned that central bankers have limited ability to cushion the global economy from the headwinds of mounting political uncertainty.

“Monetary policy is carrying too much of a burden,” he told the closing session of the Jackson Hole conference on Saturday.

--With assistance from Brian Swint and Michael McKee.

To contact the reporters on this story: Matthew Boesler in New York at mboesler1@bloomberg.net;Rich Miller in Washington at rmiller28@bloomberg.net

To contact the editors responsible for this story: Margaret Collins at mcollins45@bloomberg.net, Alister Bull, Ros Krasny

©2019 Bloomberg L.P.