Dec 9, 2019

Tullow Oil Plunges Again on ‘Materially Worse’ View: Street Wrap

, Bloomberg News

(Bloomberg) -- Want the lowdown on European markets? In your inbox before the open, every day. Sign up here.

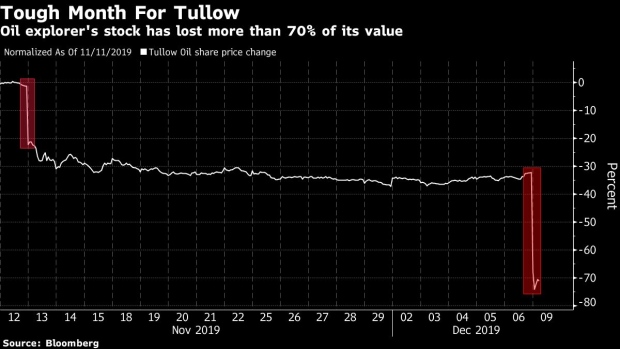

Tullow Oil Plc shares had their biggest ever drop after a forecast for 2020 production that analysts said leaves dark clouds hanging over the company’s outlook.

The stock sank as much as 62% after London-based Tullow also said Monday it would suspend dividend payments, while its chief executive officer and exploration director are to leave. It’s the second plunge in less than a month for the shares, which dropped 27% on Nov. 13 after the company said it was reassessing the commercial viability of discoveries in Guyana, South America.

Tullow on Monday predicted output of 70,000 to 80,000 barrels a day -- down from the 87,000 a day expected for this year -- amid production difficulties at two key oil fields in Ghana.

“We were concerned that Ghana production would need to be rebased given recent performance from Jubilee and TEN, but the news today is materially worse than expected,” wrote Citi analyst Michael J Alsford, who has a neutral rating on the shares.

The latest slide also hurt sentiment for some other U.K.-listed mid-cap oil shares, with partner Kosmos Energy Ltd. and close peer Premier Oil Plc falling 9.5% and 6.1% respectivaly at 11.10 a.m. in London. Tullow had pared its loss slightly, to 59%.

Here’s a summary of what analysts are saying about Tullow.

Bloomberg Intelligence, Will Hares

- Guidance “casts a dark shadow over the company’s outlook,” with issues at key projects “endemic” and unlikely to be resolved anytime soon

- Engagement of a strategic review increases the likelihood of an eventual sale of the company

Morgan Stanley, Sasikanth Chilukuru

(Equal-weight, price target 252 pence)

- Free cash flow now appears “very limited,” in terms of reducing the firm’s significant debt base

RBC, Al Stanton

(Sector perform, price target 175 pence)

- Forecast of 70,000-80,000 barrels a day compares with bank’s estimate of 88,000 b/d

- Guidance is likely to have a negative impact on the valuations of key assets, as well as impacting sentiment toward partner Kosmos Energy

Jefferies, Mark Wilson

(Hold, price target 168 pence)

- 2020 production guidance of 70,000 to 80,000 b/d compares with Jefferies estimate of 86,000 b/d

- Forecast of 70,000 b/d for following three years compares with bank’s estimate of 85,000 b/d

--With assistance from Sam Unsted and Lisa Pham.

To contact the reporter on this story: Joe Easton in London at jeaston7@bloomberg.net

To contact the editors responsible for this story: Beth Mellor at bmellor@bloomberg.net, Paul Jarvis

©2019 Bloomberg L.P.