Aug 20, 2021

Tumbling lumber prices force Conifex to curb production

, Bloomberg News

At least one mill in Western Canada has been forced to curtail production because of plunging lumber prices and soaring log costs.

Conifex Timber Inc. said it will temporarily slow production at its sawmill in Mackenzie, British Columbia, due to an “unprecedented collapse in lumber prices.” It will curtail production for two weeks starting Aug. 23.

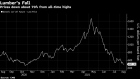

North American lumber companies may have added too much production, too quickly, as demand cools and prices for the construction material plunge. After more than quadrupling in 12 months to record highs, lumber has sunk about 70 per cent since May. The crunch is particularly acute in Western Canada because of higher costs.

Producers were swimming in cash earlier this year after rock-bottom borrowing rates during the pandemic led to a house-building boom, while locked-down home owners spent money on do-it-yourself renovations. But DIY purchases have dropped and the lumber rally has priced out some buyers.

Sawmills have ramped up production and announced large investments to expand capacity in the U.S. South, where timber plantations are plentiful and log prices are lower. Increased production, combined with slowing demand, caused lumber inventories to increase faster than expected.

More mills will likely follow Conifex’s lead with additional curtailments in the near future. If not, they will need to decide how much of their first-half 2021 profits can be thrown away while awaiting higher prices, said Greg Kuta, chief executive officer of Westline Capital Strategies Inc., which specializes in lumber-trading strategies.

“The market is still over-supplied relative to demand,” Kuta said by email. “The supply-side needs to be addressed for price stability and future price appreciation.”

U.S. lumber futures are trading around US$470 per thousand board feet, after reaching more than US$1,700 in May.

Producers in B.C.’s key Interior region are now “underwater” with regional mill cash costs around US$525 to US$575 per thousand board feet in the second half of 2021, CIBC analyst Hamir Patel said in an Aug. 19 note. An estimated 14 per cent of North America’s lumber comes from British Columbia.

The B.C. government could again raise its stumpage rates in October because the Canadian province’s system lags lumber prices by several months.

Hundreds of wildfires in the province forced other producers to announce curtailments because of evacuation orders in logging areas. Rail cargo movement has also been hindered by the fires.