Dec 24, 2020

Turkey Central Banker Faces Credibility Test: Decision Day Guide

, Bloomberg News

(Bloomberg) -- Turkish central bank Governor Naci Agbal will have to deliver another meaty interest rate hike on Thursday to fully recover monetary policy credibility with investors.

All respondents in a Bloomberg survey of 25 economists expect the Monetary Policy Committee to raise its benchmark one-week repo rate, with the median forecast for an increase of 150 basis points to 16.5%.

“To restore credibility and persuade the local investors to de-dollarize, it will need to provide a real interest rate of around two percentage points. That means a policy rate of 15%-17%,” said JPMorgan Chase & Co. analysts including Yarkin Cebeci.

The bank will start 2021 “on a strong footing” with a 200-basis-point hike, they forecast in a note, with inflation likely stuck between 13% to 15% for another six months.

Installed last month, Agbal inherited double-digit inflation, a low real-interest rate, a weak lira and depleted foreign-currency reserves after his predecessor spurred a period of rapid credit growth, urged on by President Recep Tayyip Erdogan whose unorthodox economics blame higher borrowing costs for fanning prices.

His first move to increase the benchmark by the most in over two years to 15% was more about bringing the benchmark rate into line with the central bank’s average cost of funding. Although the decision was in tune with estimates and managed to stabilize the lira, the actual tightening in monetary stance was somewhat symbolic.

Critically, though, that decision ended a complex rate-corridor structure criticized for its lack of transparency, moving Turkey to a more orthodox framework where all funding is provided through the benchmark.

Subsequent data explain why investors want to see more. Inflation in November climbed more than expected as lira depreciation filtered through to prices, cutting the real interest rate by more than half to nearly one percentage point and curbing the lira’s appeal as a carry trade.

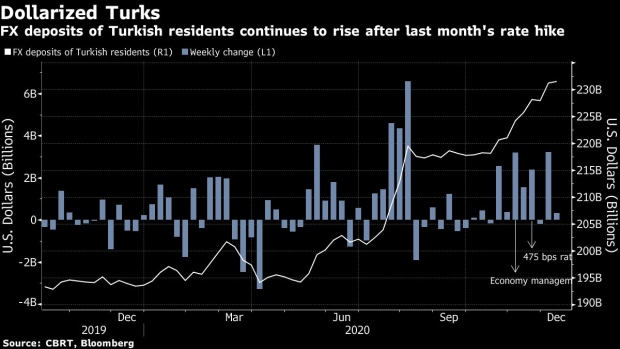

Turks are still reluctant to convert their savings to liras with foreign-currency deposits continuing to rise in December.

Turkey Promises New Era of Tight Policy, Higher Reserves

The new governor sent hawkish signals last week as he pledged to tighten monetary policy when warranted by price developments and increase the bank’s holdings of foreign assets without derailing the lira.

©2020 Bloomberg L.P.