May 29, 2020

Turkey Economy Avoids Contraction With Growth Spurt Before Virus

, Bloomberg News

(Bloomberg) --

Turkey’s economy built up enough momentum at the start of the year to clock one of the fastest expansion rates among peers during the first quarter, a period mostly before coronavirus lockdowns began to take hold.

Gross domestic product rose 4.5% last quarter from a year earlier, after a gain of 6% in the previous three months. The median of 24 forecasts in a Bloomberg survey was for 4.9%. On a quarterly basis, the economy grew a seasonally and working day-adjusted 0.6%, according to data released on Friday.

Just over a year removed from a brief recession and pumped up by monetary stimulus, Turkey surpassed countries including Indonesia, Mexico and Poland, as cheap credit at home took some sting out of the economic shock.

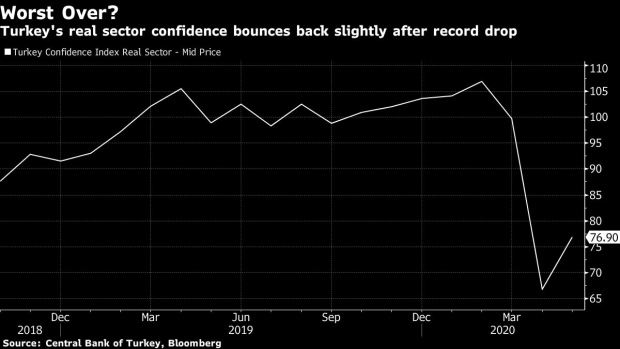

But containing the economic disruptions from the pandemic is increasingly a challenge, as business confidence crashed with the collapse of tourism and demand for Turkish exports. While the restrictions imposed in Turkey were less severe than in Italy and Spain, the government introduced some curbs within the first few days of confirming its first coronavirus case on March 10.

Turkey’s first full-year downturn in over a decade is a risk, according to most forecasters. Still, Treasury and Finance Minister Berat Albayrak has repeatedly said he expects positive economic growth in 2020.

Turkey’s prospects for the rest of the year hinge in large part on a turnaround in tourism, a critical source of revenue and employment, as well as the speed of recovery among its top trading partners in Europe, which is facing a recession as bad as the European Central Bank’s more pessimistic forecasts.

Despite signs of stabilization in economic confidence, Turkey is likely suffering a steep contraction in the second quarter. A gauge of manufacturing last month had its sharpest drop since the global financial crisis and exports and imports also plummeted.

As many countries around the world start to ease travel curbs and other containment measures, positive growth in Turkey “is not impossible” this year, according to Nigel Rendell, a senior analyst at Medley Global Advisors LLC in London.

“But it involves a huge amount of good fortune and the assumption that the world economy will return to ‘normal’ within a few weeks,” he said. “A rapid bounce-back in tourism, in particular, will be difficult and may come too late to help the summer holiday season.”

©2020 Bloomberg L.P.