Aug 4, 2020

Turkey Inflation Reaching Plateau With Currency Risks Rising

, Bloomberg News

(Bloomberg) --

Turkish inflation probably stalled for the first time in three months as the economy emerged from coronavirus restrictions, but a new round of currency depreciation threatens to set off more price pressures.

Faster increases in food costs and a recovery in energy markets have kept momentum behind consumer prices at a time when risks were already on the rise because of a weaker lira and credit stimulus in Turkey.

Still, the statistical effect of a high base of comparison after last year’s price pickup means inflation edged down slightly in July to an annual 12% from 12.6% a month earlier, according to the median of 15 forecasts in a Bloomberg survey. Turkey’s statistics agency will report the data on Tuesday.

Price gains may also have moderated in July because “a larger than normal fraction of firms adjusted their prices in June with the significant easing in Covid-19 restrictions at the beginning of the month,” according to Goldman Sachs Group Inc. economists.

The central bank has responded by leaving interest rates on hold for two months and raising its year-end projection for inflation to 8.9%. Its outlook for 2020 is still more upbeat than any of the forecasts compiled by Bloomberg.

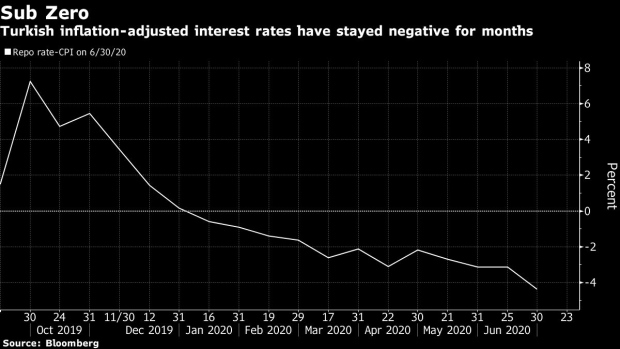

When factoring in inflation, Turkey’s official borrowing costs are among the lowest in the world and have been below zero throughout the year.

The latest bout of currency weakness could hamper efforts to keep inflation in check by making imported goods more expensive. An attempt to contain volatility in the lira by restricting foreign investors’ ability to trade the currency has only compounded a flight from Turkish assets.

The lira weakened almost 2% against the dollar last week after staying within a tight trading range since June, with its decline for the year reaching about 14.6%. It’s also near a record low against the euro.

While Goldman predicts inflation will stay near its current level over the next few months, the U.S. bank’s year-end forecast of 11.7% “seems achievable only with a flat exchange rate,” economists including Kevin Daly said in a report to clients.

“We continue to expect monetary policy to start tightening before the end of the year,” they said.

(Updates lira’s performance in eighth paragraph)

©2020 Bloomberg L.P.