Mar 29, 2023

Turkey Is Shunned by Emerging-Market Hedge Funds Before Vote

, Bloomberg News

(Bloomberg) --

Even for hedge funds that specialize in taking risks where others won’t, Turkey is a no-go zone before its election in May.

Emerging-market funds are balking at taking a position on the $815 billion economy, saying it’s impossible to predict what happens next. With President Recep Tayyip Erdogan’s administration propping up markets, asset prices have become deeply distorted and almost any scenario could be in play.

Whether or not the government changes, the tail risk for anyone considering investing in Turkey, the world’s fifth-largest developing economy outside Asia, is what happens to the lira when state support is removed or becomes unsustainable.

“It’s a completely controlled market and it’s likely to to remain under control until the elections; after the elections, it will probably free up no matter who wins,” said Trium Capital’s Peter Kisler, whose global macro hedge fund gained 56% last year. If the opposition wins a “clean” victory, “everything with the probable exception of the currency goes up.”

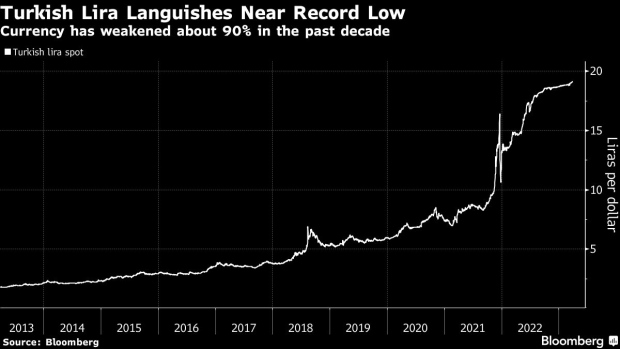

The lira has traded largely stable this year despite an inflation rate of 55% and a record current-account deficit, thanks to back-door interventions and numerous regulatory tweaks. Bloomberg reported this week that the central bank has stepped up efforts to support the currency in recent weeks, effectively acting as a matchmaker for large trades and setting exchange rates.

While Erdogan’s government says it’ll remain committed to its so-called “Turkish economy model,” whose foundation is ultra-low interest rates to try and spur growth, the opposition has vowed to throw it out the window if it wins.

READ MORE: Wharton Professor Is Waiting in the Wings to Undo Erdogan Legacy

Lira Forecasts

That’s left even some of the most risk-prone investors on the sidelines, waiting to see how policy gets adjusted.

“There is no obvious opportunity in Turkey except for the impending devaluation of the currency,” said Ali Akay, the London-based chief investment officer at Carrhae Capital LLP, whose long-short strategy returned 15.3% last year while hedge-fund peers lost about 7% overall. If the government were to cease its support, “the natural equilibrium for the lira would be at a significantly weaker level.”

Forecasts for the currency signal a significant depreciation is ahead, with Barclays PLC and TD Securities most bearish, predicting a fall of about 40% to as low as 27 per dollar in the third quarter. Forward contracts are showing that traders expect a decline after the election, regardless of who wins.

“The risk is that you end up with currency controls or a sudden devaluation,” said Kamil Dimmich at North of South Capital, whose London-based emerging-market fund has outperformed 98% of its peers over the last five years. “We currently don’t have direct exposure to Turkey because of concern around the currency.”

Foreign Exodus

Hedge funds aren’t the only investors steering clear.

Non-residents have largely exited the Turkish market over the past decade. Foreign holdings of lira bonds fell to $1.2 billion this month from $72 billion in 2013, according to data from the central bank. Foreign ownership of stocks is down to 29% from a historical average of 61%, according to official data.

One relative bright spot is the nation’s foreign-currency bonds, which have been the best performers in emerging markets this month after Morocco. But even there, international money managers now own only about a third of hard-currency government debt, down from more than half just two years ago.

The outlook is far from clear even if the incoming government makes difficult economic decisions. Raising Turkey’s artificially-low borrowing costs might help shore up the currency, but at the risk of a recession and a wave of defaults, Dimmich said.

“If the policy framework changes, then the market will move to pricing in gradual improvement,” said Pavel Mamai, the London-based founder of hedge fund ProMeritum Investment Management, which has reported positive returns every year since it was founded in 2015.

Outsized Risks

Rajat Suri, a partner at Helm Investment Partners and a former portfolio manager at Qatar Investment Authority, agrees. A return to a “more predictable policy environment would improve investor sentiment, gradually bring back foreign capital” and boost hopes for Turkish stocks.

But even with that silver lining potentially on the horizon, Helm, whose website advertises its strategy of investing in “out-of-favor countries” poised to recover from temporary political or macroeconomic dislocations, is staying out.

“For now, we are keeping our Turkish exposure deliberately small given the uncertain political outcome and outsized currency risks,” Suri said.

©2023 Bloomberg L.P.