May 25, 2023

Turkey Looks to Delay Lira Reckoning by Holding Rates: Day Guide

, Bloomberg News

(Bloomberg) -- Turkey’s central bank extended its interest-rate pause for a third month as it tries to keep the lira stable just before a presidential runoff in which incumbent Recep Tayyip Erdogan is seeking reelection.

The Monetary Policy Committee led by Governor Sahap Kavcioglu left its one-week repo rate at 8.5% on Thursday, in line with all forecasts. The lira was little changed after the decision.

Read more: Turkey Set for Runoff as Erdogan Falls Just Short of Victory

The decision may buy the central bank more time as it faces down pressure on the Turkish currency ahead of Sunday’s vote. Erdogan won 49.5% of the votes in the first round, more than polls had predicted and leaving him just shy of the 50% threshold needed to avoid a runoff.

With the lira already trading around a record low, a longer pause is among the few policy choices left as market expectations mount for a steeper decline regardless of who wins the second-round vote. Erdogan, a self-styled enemy of high borrowing costs, has ruled out rate hikes.

In a statement accompanying its decision, the central bank repeated that its stance is currently “adequate to support the necessary recovery in the aftermath” of the earthquakes that hit Turkey in February.

What Bloomberg Economics Says...

“The central bank kept its policy rate on hold at its May meeting, but we expect it to continue using tighter bank regulation and stealth currency market interventions in the near term to minimize the negative impact of its loose stance on the lira.”

— Selva Bahar Baziki, economist. Click here to read more.

“Recent data show that economic activity in the earthquake zone has been recovering faster than expected,” the MPC said. “It is becoming evident that the earthquake will not have a permanent impact on performance of the Turkish economy in the medium term.”

Global Outlier

Turkey has remained an outlier as policymakers around the world unleashed the most aggressive monetary tightening in decades in response to price shocks. Under Kavcioglu, the central bank heeded Erdogan’s calls for cheap money to boost economic growth by cutting rates even as inflation soared.

Erdogan last week reiterated his view that Turkey’s low-rates policy would continue after elections, and inflation — currently at an annual 44% — would slow as a result. For most mainstream economists, the approach is unsustainable and increasingly puts Turkish assets at risk of a selloff.

Unease over the steps taken by officials is playing out in the market. The lira has lost 6% of its value against the dollar so far this year.

Lacking the option of raising rates, efforts to defend the lira have instead relied on a patchwork of measures such as limiting the amount of dollars lenders can purchase in the interbank market and pressuring them to increase the conversion of foreign-exchange savings into lira deposits.

Read more: Turkey’s Lira Defense Moves Into Full Swing Before Runoff

The central bank also told lenders to buy dollar bonds aimed at keeping borrowing costs stable and prevent a spike in credit-default swaps — a measure of protection against potential credit events, according top people familiar with the discussions.

The cost of insuring against a sovereign default over the next five years this week rose to its highest in over six months earlier this week.

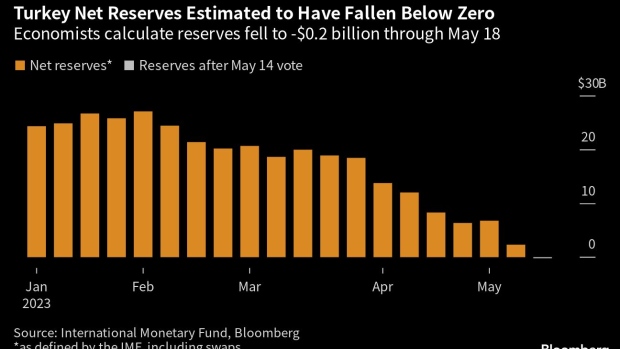

The central bank has additionally been ramping up interventions in the currency market, an approach so costly that it helped push net reserves — as defined by the International Monetary Fund — slightly below zero in the week after the first round of elections on May 14.

Erdogan’s edge over his key rival in the first round of voting, and his alliance retaining its majority in parliament, probably mean the president’s unconventional policies may stay for as long as Turkey can afford it.

The main opposition candidate, Kemal Kilicdaroglu, has promised a return to orthodox economics if elected.

--With assistance from Joel Rinneby.

(Updates with lira’s performance, economist comment and net reserves starting in second paragraph.)

©2023 Bloomberg L.P.