Feb 8, 2023

Turkey Risks Inflation Surge, Budget Breach as Quake Costs Mount

, Bloomberg News

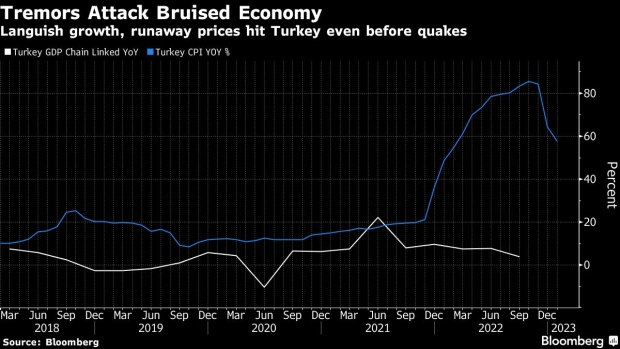

(Bloomberg) -- A daunting economic landscape will exacerbate the humanitarian catastrophe wrought by a pair of earthquakes on Turkey, as early estimates of the damage point to mounting inflation and budget risks.

Turkey has suspended trade on its main stock stock exchange following a sharp drop and the lira remains propped up by support measures. Meanwhile, Turkish financial assets whose movements remain unrestricted largely stabilized, with some even appreciating on Thursday.

Analysts are trying to gauge the exact impact of Monday’s tremors on Turkey’s $819 billion economy, which has seen massive imbalances amid unorthodox policies aimed at curbing inflation while also slashing interest rates. The plunge in equity prices and jump in bond yields after the quake pointed to fears over economic growth and excess spending.

“The costs of this disaster strike the Turkish economy at a time when sentiment was already fragile,” said Nick Stadtmiller, head of product at Medley Global Advisors in New York. It also “increases the risk of another market meltdown given the pre-existing vulnerabilities in the currency and external account.”

While the Istanbul stock exchange was shut for a second day, the iShares MSCI Turkey UCITS ETF, an exchange-traded fund tracking Turkish assets in Europe that’s still trading, rebounded after three days of declines. It was 0.5% higher as of 10:08 a.m. in London after losing 14% over the previous three days.

The yield on Turkey’s new dollar bond maturing in 2033 declined 2 basis points to 9.80% on Thursday, compared with last week’s close at 9.61%.

The death toll across Turkey and neighboring Syria surpassed 16,000 as of Thursday morning, with thousands more trapped inside buildings damaged in the temblors that struck three days earlier. While the immediate focus is on rescue operations, the need to make plans for rebuilding before elections due in May is likely to put President Recep Tayyip Erdogan’s government under even more pressure to unveil enhanced spending plans.

Read More: Erdogan Wants Elections in May Despite Earthquake Fallout

Signs of changes to economic policy and what’s likely to be a massive spending increase were already evident on Wednesday as Erdogan visited the affected areas. He said a rebuilding blitz across 10 provinces would be completed within a year, announced a handout of 10,000 liras ($531) to each affected family, and said survivors housed in tents could be transferred to hotels on the coast.

“We make an initial rough estimate that public spending on Monday’s quakes may be equivalent to 5.5% of GDP,” wrote Bloomberg economist Selva Bahar Baziki. “A likely government-backed credit scheme could result in a higher number,” resulting in a break of budget targets.

EuroEco Brief: Turkey Quake Spending May Reach 5.5% of GDP

The task of estimating the exact impact of the quakes is complicated by the region’s role in Turkey’s economy. On the surface, the 10 provinces most affected by the quakes account for a relatively small part of GDP by themselves.

However, they also form an industrial and agricultural corridor that plays a key role in the prosperity of Istanbul and other larger cities. Oxford Economics said near-term disruptions to activity in the 10 provinces will alone shave off 0.3% to 0.4% of GDP.

“A relevant recent natural disaster precedent might be the floods in Pakistan, which may have erased 5%-10% off GDP and, obviously, had a negative knock-on impact on external-account vulnerability,” said Hasnain Malik, a strategist at Tellimer in Dubai. “The impact is likely significantly less in Turkey in GDP terms but it exacerbates the existing pressure on its external account and currency.”

The damage in agriculturally productive areas could result in food shortages and increase inflation in a country where the consumer-price index hovers just under 60%. Erdogan’s well-known support for looser monetary policy has left prices unanchored, and given Turkey one of the highest inflation rates in the world.

The quakes’ impact on the lira has so far been muted, with the currency trading in a tight range largely managed by authorities. They’ve installed supportive measures and a slew of regulations to counter the impact of Erdogan’s low interest-rates policy on the currency.

“The lira is not the most accurate barometer of market sentiment toward Turkey, given that it remains supported by backdoor interventions,” said Piotr Matys, a senior analyst at In Touch Capital Markets. “The central bank is likely to be under even stronger pressure from the Erdogan administration to cut rates to finance recovery.”

Turkey’s “blue chip” corporate issuers have also seen their international bonds hold up, as most have diversified business with revenues in euros or dollars, according to Todd Schubert, head of fixed-income research at Bank of Singapore. “While the earthquake was indeed a human tragedy, it is not an event that adversely impacts the credit trajectory to a significant manner,” he said.

Inflation Hedge

For equity investors, the plunge in the benchmark Borsa Istanbul 100 Index took away a key hedge against inflation. Local buyers had been parking funds in stocks to tide over runaway price growth that exceeded an annual 85% in October. A three-year rally driven by that desperate demand came to an end in 2023, sending the gauge to the world’s worst performance.

Turkey Suspends Trading in Stock Market After Rout Deepens

While the earthquake amplifies the “overall bearish tone” on Turkish equities, their long-term outlook will hinge on inflation, Erdogan’s “unorthodox policies” and elections in May, according to Nenad Dinic, an equity strategist at Bank Julius Baer.

“It will take a number of months to determine the economic impact, given the unknown direct and indirect losses from the earthquake,” said Simon Quijano-Evans, chief economist at Gemcorp Capital Management. “In the short-term, the country will need to see emergency fiscal and monetary policy measures, with international support a must in order to secure stability in the wider region.”

(Updates markets and developments, adds Bank of Singapore comment)

©2023 Bloomberg L.P.