Oct 21, 2021

Turkey’s Central Bank Cuts Rates Again at the Lira’s Expense

, Bloomberg News

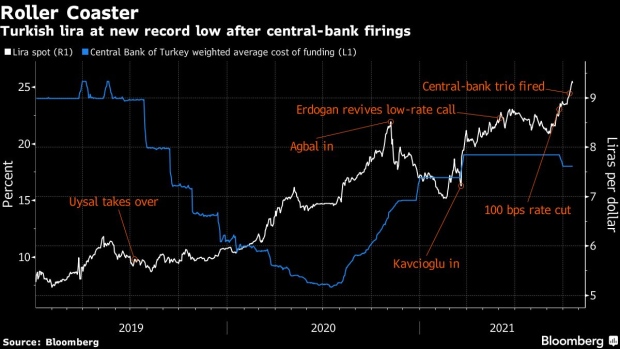

(Bloomberg) -- Turkey’s central bank chief, powered by President Recep Tayyip Erdogan’s unorthodox monetary ideas, delivered a bigger-than-expected interest-rate cut despite rising inflationary pressures and a lira slumping to record lows. The lira sank.

The Monetary Policy Committee reduced its key one-week repo rate by 200 basis points to 16%. All 26 economists surveyed by Bloomberg expected Governor Sahap Kavcioglu to continue monetary easing after Erdogan rid the monetary authority of policy makers opposed to his calls for lower borrowing costs. While most forecast a reduction of 100 basis points, a sizable minority saw half of that.

The lira extended losses and was trading 2.4% lower at 9.4570 per dollar at 2:02 p.m. in Istanbul.

A self-described “enemy” of high interest rates, Erdogan espouses the unconventional hypothesis that reducing them will lead to lower inflation. He appointed Kavcioglu in March, replacing hawkish predecessor Naci Agbal after back-to-back rate hikes. Kavcioglu kept policy unchanged for nearly six months before unexpectedly cutting the benchmark rate by 100 basis points to 18% in September, when consumer inflation accelerated to 19.6%.

Last week’s monetary policy committee reshuffle pushed the currency to new lows, extending its losses this year against the dollar to over 20%, more than any other major currency tracked by Bloomberg.

Some economists, even as they forecast a cut, argued that the central bank should have raised rates. “Everyone knows that they shouldn’t cut rates further and in fact they should be hiking,” said Piotr Matys, a senior currency analyst at InTouch Capital in London, before the decision.

“Students of economics will learn about the CBRT for years to come, as it will be used as an example to show why it’s so important to have an independent central bank with strong credibility,” Matys said, referring to the central bank by its English-language acronym.

Kavcioglu will update the bank’s base-case scenario for inflation through the rest of 2021 and the following two years on Oct. 28, and answer questions from economists and reporters. The central bank currently sees consumer-price growth finishing the year at 14.1%, a more optimistic forecast than the government’s latest estimate of 16.2%.

The statistics agency will publish October inflation data on Nov. 3.

©2021 Bloomberg L.P.