May 30, 2023

Turkey’s Early-2023 GDP Growth to Slow as Economic Woes Mount

, Bloomberg News

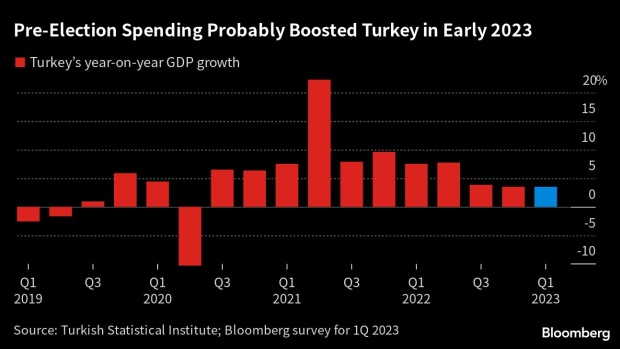

(Bloomberg) -- Turkey’s economy was boosted at the start of the year by pre-election spending and strong household consumption. The rest of 2023 will probably be tougher as the newly re-elected president battles a cost-of-living crisis.

Gross domestic product probably grew 3.5% year-on-year in the first quarter and 0.5% from the previous period, according to a Bloomberg survey. Fiscal stimulus and lower interest rates helped ease the economic impact of two massive earthquakes in south-east Turkey in February.

The data, scheduled be released on Wednesday, will come following Sunday’s run-off in Turkey’s presidential election. Recep Tayyip Erdogan defeated Kemal Kilicdaroglu to extend his rule into a third decade.

The country was the fastest-growing economy in the G-20 last year after Saudi Arabia and India, rising more than 5%. Erdogan’s administration fueled that expansion through cheap lending and heavily subsidized utility bills, as well as increases in the minimum wage and pensions.

Those moves and ultra-loose monetary policy have come at the expense of currency and price stability, with inflation peaking at 86% last year. It’s decelerated but is still as high as 44%, more than anywhere in the G-20 except Argentina.

What Bloomberg Economics Says...

“We expect the year-on-year GDP growth reading at 4.8% for 1Q23, following 4Q22’s 3.5%. That reflects pre-election and earthquake-related spending, alongside a quick recovery in disaster struck areas. Consumers front-loading their purchases as they face persistently high inflation, was also one of the factors.”

— Selva Bahar Baziki, economist. Click here to read more.

With victory secured, Erdogan’s giveaways are expected to pause as his officials shift their focus to widening budget and current-account deficits.

Growth will dip to 1.6% in the second quarter year-on-year, according to a Bloomberg survey of economists, and to 2.7% for 2023 as a whole.

“We expect policy to tighten in the second half, leading to a slowdown in growth,” said Goldman Sachs Group Inc. economists including Clemens Grafe. They cited a decline in foreign reserves and a current-account deficit of more than 6% of GDP in the first quarter.

©2023 Bloomberg L.P.