Feb 19, 2023

Turkey’s Endless Tinkering in Markets Is Driving Investors Away

, Bloomberg News

(Bloomberg) -- Before last week, the stock market was one of Turkey’s last economic pillars that was largely free from the political whims of the state. That’s not the case any more.

Through a series of elaborate rapid-fire changes, the government pushed cash into the stock market and engineered a $20 billion rally in its benchmark BIST 100 Index over three days. On paper, BIST 100 index is still near an all-time high, but in reality, Turkey has moved another step further from the world of normal finance.

Investors in New York, London and elsewhere say they don’t want to put money in a stock market where the rules change depending on who’s in power, but it’s hard to know whether the maneuvers are a stop-gap during a crisis or a political play to keep asset prices high before Turkish President Recep Tayyip Erdogan faces elections in May.

“There is no market any longer,” said Wolfango Piccoli, the co-president of Teneo Intelligence. “It’s all about short-term political goals and all about endless interference by the local authorities, who are using all sorts of tricks to provide a facade of normality.”

Policymakers pulled on a range of levers to bolster the stock market in the past week by directing private pension funds and state lenders to buy equities and scrapping taxes on corporate buy backs. As a permanent step, Turkey’s sovereign wealth fund is planning to create a new mechanism allowing the government to buy stocks at times of high volatility.

Mobius Warns of Boomerang Risk as Turkey Works to Prop Up Stocks

Some investors caution about reading too much into changes coming days after the worst earthquake in decades. They say it might only be a temporary, akin to circuit breakers in times of market stress, and not a sign that the government wants an active hand in trading.

“Short-term measures to rebalance market disorder and reduce volatility after the tragic earthquake seem mostly justified,” said Nenad Dinic, an equity strategist at Bank Julius Baer. “We see little risk of an unwanted intervention policy.”

More pessimistic investors are interpreting the stock-market changes as an expansion of the government’s control, which already reaches deep into Turkey’s currency and bond markets.

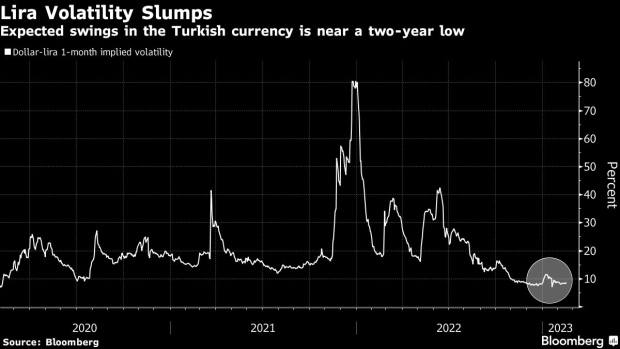

Since Erdogan’s pivotal election in 2018, which granted him vast power in a new presidential system, the government has adopted increasingly unorthodox tactics, from cutting interest rates at a time of double-digit inflation to tweaking banking regulations as a backdoor way to support the lira.

The result has been an exodus of foreign money from Turkey, once seen as a darling of emerging-market investors for its free-market policies. The overwhelming state support for equities still failed to attract US investors: a New York-listed exchange-traded fund investing in Turkish stocks saw little new capital except for a $6.8 million single -day inflow. Gains fizzled in the iShares MSCI Turkey ETF toward the end of the week.

Overseas investors now hold only about 30% of Turkish equities, compared with average of 60% over the past two decades, according to data from the clearing house Takasbank. In bonds, foreign ownership is close to 1%, down from 28% in 2013.

In the MSCI Emerging Markets Index, Turkish companies account for about 0.5% of the benchmark. That puts it on par with Chile, which has an economy about half the size.

The emergency measures sent the BIST 100 up 12% for the week, and since the start of 2022, the index has more than doubled in lira terms. In Turkey, where the government keeps interest and deposit rates artificially low and bonds yield much less than inflation, stocks and gold are some of the few logical refuges left for savings.

To international investors, Turkey’s stock market changes have raised the risk that regulations are turning the country into a more closed market, mostly relevant to locals. Before the earthquakes, the BIST 100 was the worst-performing stock market in the world this year.

In the view of Nick Stadtmiller, head of product at Medley Global Advisors in New York, it’s going to be hard for the government to keep the stock market high with constant intervention.

“The problem is the stock market almost surely needs fresh buying to remain at lofty levels,” he said. “Officials will have to continue intervening to prevent a stock-market collapse, which would harm consumer sentiment and spending.”

Other investors have shrugged off the concerns about investing in Turkey, saying it’s part of the risk that comes with emerging markets. Carlos Hardenberg, a portfolio manager at Mobius Capital Partners, said he’s keeping Turkish stock holdings steady and waiting to see how the election pans out.

“We have seen this in other countries as well and the measures are temporary,” he said. “Obviously the authorities should stay out of the market in general as this would cause a loss of confidence.”

(Changes headline, adds data on ETF in 10th paragraph)

©2023 Bloomberg L.P.