Dec 23, 2021

Turkey’s Missing Billions Signal Unannounced Lira Intervention

, Bloomberg News

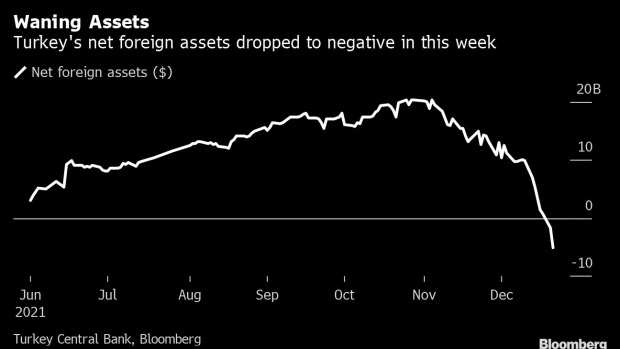

(Bloomberg) -- Turkish net foreign assets fell by nearly $6 billion early this week as President Recep Tayyip Erdogan unveiled plans to bolster the lira, suggesting Turkey made unannounced interventions in foreign-exchange markets.

While the government has said it didn’t intervene, the fall of $5.9 billion probably signals a backdoor intervention similar to operations carried out over two years from October 2018, when state lenders sold dollars to support the local currency.

Net foreign assets dropped to minus $5.1 billion on Tuesday compared with $817 million on Friday, according to calculations by Bloomberg using the monetary authority’s daily analytical balance sheet.

The U.K.’s Financial Times reported earlier on the change in Turkey’s net foreign assets.

Erdogan on Monday rolled out a series of extraordinary measures to support the plunging lira, which at that point had shed more than 50% of its value against the dollar this year. The currency slump was fueled by central bank rates cuts demanded by the president, but authorities acted as the lira’s losses threatened to accelerate inflation that’s already over 20% and eroding support for the ruling party.

The lira appreciated as much as 25% on Monday after Erdogan spoke, its biggest daily jump since 1983, and has now gained more than 40% against the dollar this week.

The lira’s move on Monday was supported by state banks, according to four people who asked not to be identified by name. At least one private lender was also involved, said one person familiar with the transactions. The sales continued Tuesday, said the people.

At the center of Erdogan’s plan is a new instrument intended to suppress retail investor demand for dollars. If the lira’s decline against hard currencies exceed banks’ interest rates, the government will pay holders of lira deposits the differential.

Net reserves dropped to $12.2 billion as of Friday, showing the impact of last week’s direct sales, which were announced by the central bank. The dip of about $9 billion was the biggest weekly drop in data that goes back at least 2002.

Global banks including Goldman Sachs predict more than $100 billion of central bank reserves were spent to prevent a disorderly depreciation in the lira last year alone, when the currency came under pressure after a series of large rate cuts to support the pandemic-hit economy.

Earlier this year, Erdogan said authorities used $165 billion of central bank foreign-currency reserves to weather developments in 2019 and 2020, and may use them “again when needed.”

©2021 Bloomberg L.P.