Mar 21, 2023

Turkey’s Stock-Buying Bonanza Flops as Technicals Signal Selloff

, Bloomberg News

(Bloomberg) --

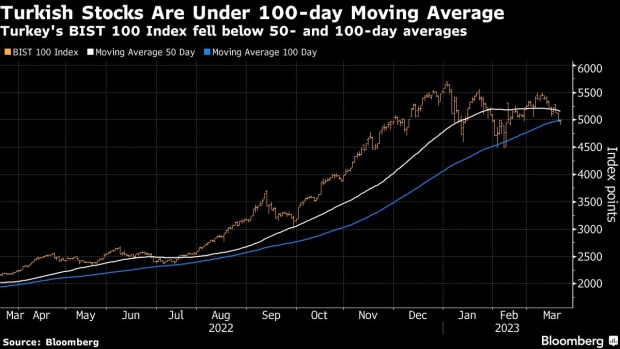

Turkish stocks may extend a selloff that’s sparked the worst quarterly decline since the onset of Covid as investors fret over political risk in the run-up to the presidential elections.

Technical patterns have turned bearish in the Borsa Istanbul 100 Index, the country’s equity benchmark that has tumbled 11% since the start of 2023. Moving averages to momentum charts signal an accelerating negative bias in the market despite state support that’s channeling billions of liras to buy shares.

Elections in May have turned into a high-pitched battle between President Recep Tayyip Erdogan and a united opposition trying to dislodge his two-decade-long regime. At stake for investors is the future of fiscal and monetary policies: Erdogan’s unconventional approach that requires persistently low interest rates has sparked runaway inflation and driven away foreign investors from most Turkish assets. This year, devastating earthquakes, disagreements within the opposition’s alliance and a souring of global risk appetite have further hampered sentiment.

Moving Averages

The Borsa Istanbul gauge closed below its 100-day moving average on Monday, for only the second time since October 2021. The measure has posted losses on seven of the past eight days, defying repeated stock buying by the funds of brokerage Ziraat Portfoy, armed with inflows of $465 million. Traders say Turkey’s sovereign wealth fund is channeling cash through the brokerage to support stocks, but the breach of the support level suggests investors aren’t joining the purchases.

Negative Momentum

The index’s Moving Average Convergence Divergence indicator, which is used to signal trend reversals, now shows that Turkish stocks may have switched to a falling trend. The daily MACD line crossed below the red signal line, while the weekly line still remains below, another sign of short-term weakness. The MACD line has also declined through the zero line recently.

Directional Movement Index

The gauge’s directional movement index (DMI) compares successive days’ highs and lows to measure momentum. It sent a bearish signal 10 days ago.

©2023 Bloomberg L.P.