Sep 24, 2020

Turkey Stuns With First Rate Hike Since 2018 Currency Crisis

, Bloomberg News

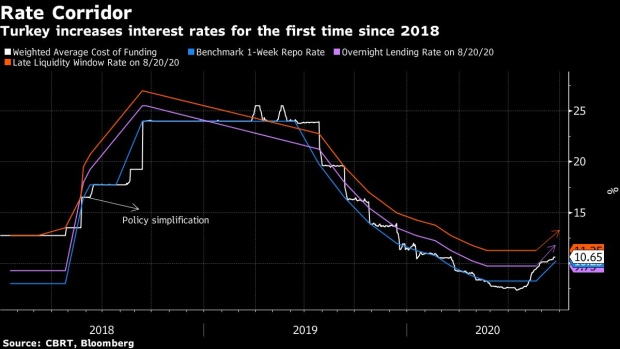

(Bloomberg) -- Turkey’s central bank raised interest rates for the first time since a currency crisis in late 2018, surprising most economists after a series of backdoor measures fell short of stabilizing the lira.

The Monetary Policy Committee led by Governor Murat Uysal increased the benchmark one-week repo rate to 10.25% from 8.25% on Thursday. Most economists in a Bloomberg survey predicted no change. The lira surged after the announcement and traded 1.2% stronger against the dollar as of 2:35 p.m. in Istanbul.

The decision caps a period of tightening by stealth since August as the central bank tried to contain the lira’s weakness by using fringe tools and ceasing to provide funding at its cheapest benchmark rate. Investors questioned the approach for its lack of transparency and the ease with which the measures can be unwound.

“The Committee assessed that the tightening steps taken since August should be reinforced in order to contain inflation expectations and risks to the inflation outlook,” the central bank said in a statement.

Despite President Recep Tayyip Erdogan’s appeals for lower borrowing costs, the central bank has already responded to market turmoil by tweaking the cost of funding on a daily basis, modifying the amount of liquidity available to lenders across its various rates. The average cost of cash provided by the central bank rose to 10.65% on Wednesday as a result, compared with as low as 7.34% in July.

Timothy Ash, a strategist at BlueBay Asset Management in London, called Thursday’s decision a “massive surprise, and positive.”

‘Fighting Chance’

It “suggests the Turkish central bank listened to the market and decided they had to move to avoid a disorderly devaluation and potential balance of payments crisis,” he said. “They are not out of the woods yet, but they have given themselves a fighting chance.”

The pivot under Uysal’s leadership runs the risk of angering Erdogan, who’s a firm believer that high rates cause inflation. Most economists and central banks around the world believe the opposite to be true.

Until June, the central bank delivered 1,575 basis points of easing in nine consecutive steps, leaving Turkey’s inflation-adjusted borrowing costs among the lowest in the world. The monetary authority stood pat since then, even as the lira racked up the biggest losses against the dollar in emerging markets during the second half.

Under Uysal’s predecessor, who was fired by Erdogan for not lowering borrowing costs, the central bank shifted its focus to a single benchmark rate in 2018. The move was lauded at the time as a “simplification” of Turkey’s monetary regime, and a step toward making policy more predictable.

The return of a less transparent approach brought back uncertainty just as investors demanded higher rates to hold Turkish assets.

“A rate hike was urgently required and finally Turkey’s central bank pulled the trigger,” said Piotr Matys, a London-based strategist at Rabobank. “That said, we have to be mindful that today’s rate hike may still not prove sufficient to stabilize the lira in a sustainable way without the Erdogan administration making progress on structural reforms.”

(Updates with Bloomberg economist’s comment under ‘Fighting Chance’ subheadline.)

©2020 Bloomberg L.P.