Nov 24, 2022

Turkey to Cut Rates Into Single Digits as Pause Looms

, Bloomberg News

(Bloomberg) --

Turkey is poised to cap off its abrupt cycle of monetary easing with another interest-rate cut on Thursday, before a likely pause that will test the central bank’s ability to keep a grip on the lira and inflation.

Policy makers are delivering on a call by President Recep Tayyip Erdogan to bring rates into single digits before the end of this year as Turkey enters a final stretch before elections just months away.

Economists surveyed by Bloomberg are unanimous in predicting a 150 basis-point cut in the benchmark to 9%. In October, the central bank lowered rates by the same magnitude and said it would consider taking a similar step before ending the cycle this month.

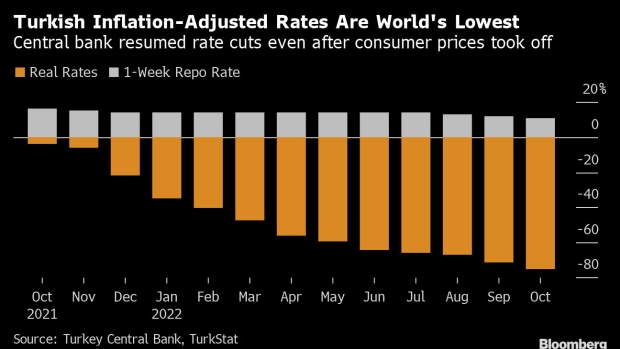

The fourth straight rate cut would underscore Turkey’s extreme outlier status during a year that’s seen the world’s most aggressive and synchronized monetary policy tightening in 40 years in response to inflation shocks.

Turkey has done just the opposite, guided by Erdogan’s unconventional belief that lower rates have the power to cool inflation. The central bank has slashed official borrowing costs by 350 basis points since August despite price growth that’s exceeded 85% and will likely end the year as the second-highest in the Group of 20 after Argentina.

Erdogan fired all three of Governor Sahap Kavcioglu’s predecessors for taking a line he deemed insufficiently dovish. The president has been pressing for lower rates to turbocharge the economy by promoting cheap loans.

Annual inflation is now 17 times higher than the official target and the fastest since Erdogan took power two decades ago.

What Bloomberg Economics Says...

“Despite the loose policy stance, inflation will likely start decelerating from November onwards due to high base effects. But we expect inflation to remain elevated, as the central bank’s rate cuts will feed back into higher prices. Expansionary fiscal policies ahead of elections will further fuel price gains.”

-- Selva Bahar Baziki, economist. Click here to read more.

Turkish officials have pinned much of the blame on Russia’s invasion of Ukraine for stoking energy costs. Erdogan has also threatened a crackdown on grocery stores for not keeping prices under control.

The central bank expects inflation to end the year at about 65%, a more upbeat assessment than the view of many economists. Last month, Kavcioglu conceded that “we cannot count ourselves as successful in lowering inflation.”

To prevent the lira’s slide, policy makers have instead been intervening in the currency market and putting pressure on commercial lenders to limit purchases of foreign exchange by their clients.

TURKEY INSIGHT: Rate Cuts Speed Up Currency Intervention to $98B

While the costs of the ultra-loose approach are mounting, the central bank boasts gross reserves that have grown to their highest this year and are set to rise further by the end of this month.

Still, the lira has depreciated almost 29% against the dollar this year, the worst performer in emerging markets after the Argentine peso.

Saudi Arabia Set to Deposit $5 Billion at Turkish Central Bank

The elevated reserves will “provide a buffer in case there is lira selling pressure,” said Marek Drimal, a Societe Generale strategist.

Drimal, who expects rates to be further cut to 8% in December, said the lira would remain “roughly stable until mid-2023, due to the impact of the mix of policies aimed at anchoring the currency.”

--With assistance from Harumi Ichikura.

©2022 Bloomberg L.P.