Aug 18, 2022

Turkish Lira Tumbles After Central Bank Delivers Shock Rate Cut

, Bloomberg News

(Bloomberg) -- Sign up for our Middle East newsletter and follow us @middleeast for news on the region.

The shock decision by Turkey’s central bank to cut interest rates against a backdrop of soaring inflation surprised analysts and economists, who expect further intervention in currency markets as pressure builds on the lira again.

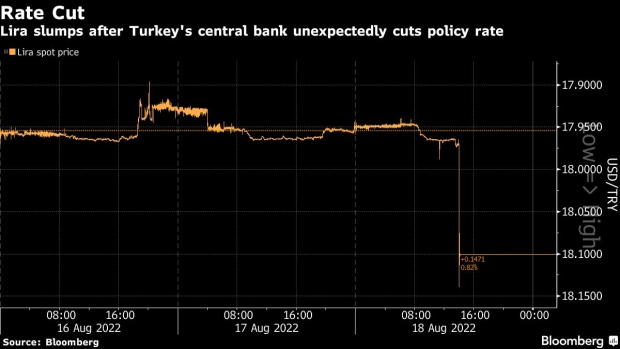

The currency weakened as much as 1% to 18.1394 per US dollar, falling to its lowest since Dec. 20, before trading 0.7% weaker as of 4:03 p.m. in Istanbul.

Policy makers lowered the benchmark rate to 13% from 14% on Thursday, where all 21 economists surveyed by Bloomberg had predicted rates would remain unchanged. The central bank had previously stood pat on borrowing costs at its last seven meetings.

Turkey Delivers Shock Rate Cut Despite Inflation; Lira Plunges

Turkey’s five-year credit default swaps added 33 basis points, rising to the highest since Aug. 3. The Borsa Istanbul 100 Index rallied after initially dropping as much as 1.9% after the decision, trading up 0.4%.

Here’s what analysts are saying:

Cristian Maggio, head of portfolio strategy at TD Securities:

- “The lira remains heavily managed thorough direct/indirect interventions, and foreigners have been mostly sidelined since 2018. What is left in the driver’s seat is strong local FX conversion activity. Summer markets, foreign flows from friendly countries (more recently Russia and Saudi Arabia) plus the tourist high season bringing fresh hard currencies to Turkey may have helped the CBRT keep a lid over USDTRY, avoiding a decisive break above the 18 handle. Today’s announcement opened that lid.”

- “The CBRT will certainly resist, putting more money on the line. This means keeping a closer eye on the dynamic of the CBRT’s daily swap auctions, among other tools to support the lira. An acceleration in new swap agreements, as we now forecast, would suggest an intensification of headwinds for the lira and the risk that the CBRT may soon have to reverse today’s mistake.”

Nick Stadtmiller, director of EM at Medley Global Advisors:

- “Macroprudential policies affecting the cost and allocation of credit will be far more important than fiddling with the policy rate by 1% or 2% here or there.

- “The CBRT has room to continue intervening in the foreign-exchange market for now, with seasonal inflows from tourism and recent deposits from Russia.”

- “The CBRT has enough room to continue its policy mix of low rates and sustained currency intervention to slow the lira’s declines. The longer they sustain this mix, the larger macro imbalances that will build up. But they can maintain these policies for now. I think they have space to continue this through the end of the year, and possibly until the middle of next year.”

Emre Akcakmak, senior consultant to East Capital, based in Dubai:

- “Almost a year down the road from its first unexpected rate cut when inflation was close to 20%, the central bank went head on with its authentic monetary policy to deliver another surprise cut despite Turkey’s world-leading inflation rate reaching 80%.”

- “One can assume that number one priority is economic growth as opposed to price stability. This is typically what happens when electionomics take centre stage. Efforts spent to go from point A to point B (ie. election time), but caution is required as stretching the system too much might eventually break things.”

Marek Drimal, strategist at Societe Generale London branch:

- “It is clearly a surprising decision. It’s clear that the economic outlook is deteriorating in the EMEA region and we are going to see a very difficult winter, not just in Turkey but in the whole region. But this cut is likely to exacerbate a weakening of the lira, as other central banks in the region continue to hike or at least opt for a stability.”

©2022 Bloomberg L.P.