Feb 16, 2023

Turkish Stocks Recoup Post-Quake Losses Thanks to Measures

, Bloomberg News

(Bloomberg) --

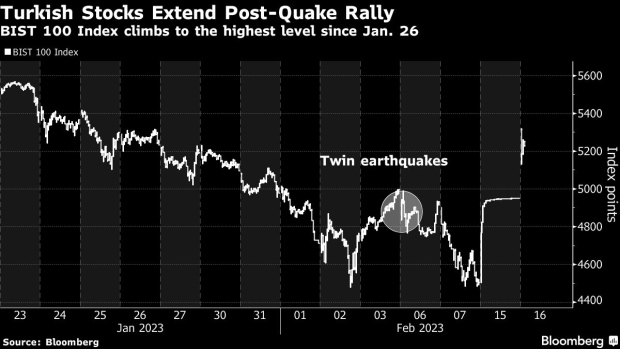

Turkish equities have reversed their post-quake losses in a little more than a day, less than the amount of time it took for the big slump to occur, thanks to government measures to support the country’s stock market.

The benchmark Borsa Istanbul 100 Index rose as much as 7.5% before closing 1.2% higher in Istanbul on Thursday. The index extended its two-day gains to 11%, the biggest such rally since 2008. It was also about 11% above its Feb. 7 low.

The rebound came after authorities showed their determination to reverse a rout that erased tens of billions of dollars from the market value of Turkish companies in the two days of trades that followed the Feb. 6 earthquakes. Among the measures with the most expected impact were the Turkish government’s channeling of billions of liras from pension funds and state lenders into the stock market, and encouraging buybacks.

Turkey Injects Billions of Liras to Prop Up Stocks Before Open

The New York-traded iShares MSCI Turkey ETF, the largest exchange-traded fund tracking Turkish stocks, climbed 9.6% on Wednesday, extending its gains and cueing for the rally’s continuation.

However, veteran emerging-markets investor Mark Mobius sounded a note of caution, saying Turkey’s efforts to prop up stocks as they reopen following the earthquake-fueled rout could have the opposite impact.

“We can understand the government’s desire to limit the impact of the disaster on the market as a whole,” Mobius said by email in response to Bloomberg’s questions. “However, such interventions often have an impact opposite from what is intended.” He still has a long-term positive outlook on the country’s stocks.

--With assistance from Farah Elbahrawy.

(Updates with prices in second paragraph.)

©2023 Bloomberg L.P.