Dec 3, 2019

Twitter's Rare Offering to Junk Market: A Profitable Tech Issuer

, Bloomberg News

(Bloomberg) -- As it prepares its debut in the junk-bond market, Twitter Inc. is employing a strategy that looks downright quaint for a high-flying technology firm: making money.

The social media company, which posted $856 million of free cash flow last year, can expect to be rewarded for its prudence. It garnered credit ratings in the top tier of high-yield and is marketing its $600 million deal at a yield of around 4.5%, more than a percentage point lower than average for speculative-grade debt.

Its approach stands in contrast to companies like WeWork and Tesla Inc., both of which issued junk bonds while burning cash and have seen their notes underperform. Even Netflix Inc., which has become something of a bond-market darling after issuing billions of dollars of debt to help fund new programming, isn’t cash-flow positive.

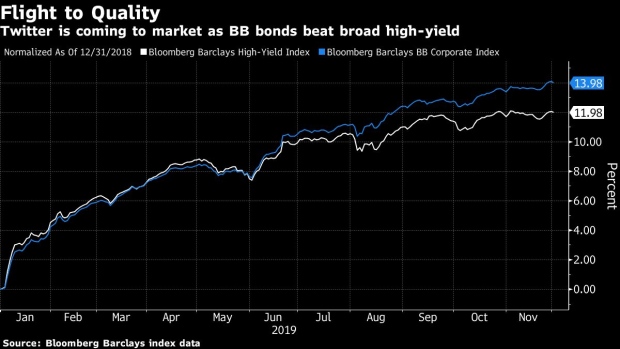

Twitter’s financial profile may not resemble some of its cash-burning peers, but it does emulate the kind of company investors have been most eager to lend to this year amid fears of a broad economic downturn. Jittery debt buyers have helped notes issued by the highest-quality junk borrowers return some 14%, outperforming riskier securities like CCC rated debt.

“It’s an up-in-quality trade across all asset classes,” said John McClain, a high-yield portfolio manager at Diamond Hill Capital Management. “Nobody wants to be caught with their hand in the cookie jar. This is the cookie jar moment.”

Twitter’s previous forays into debt markets have primarily been via convertible notes, a type of hybrid security that pays interest, like bonds, but can be exchanged for stock after a company’s shares rise above an agreed-upon price.

Historically they’ve been popular with fast-growing technology companies that may lack the credit grades necessary to drum up support in traditional debt markets. Tesla was also a convertible issuer before it debuted in the junk-bond market.

Unlike equity investors that typically prioritize a company’s growth, bondholders care most about getting paid back, and are therefore often wary of lending to cash-burning companies.

Yet a relentless demand for higher yielding assets in recent years has allowed more and more money-losing firms to access debt financing, led by Netflix. The company has become a regular issuer in the U.S. and European markets, benefiting from investor confidence that it will ultimately become cash-flow positive as it pares back spending on new programming. That’s helped push the company’s debt above par.

Newer technology issuers hoping to replicate Netflix’s approach have had varying levels of success. Tesla sold bonds in 2017 to ferocious demand, only to see the debt sink to as low as 81 cents on the dollar as investors fretted that the electric carmaker couldn’t find a sustained path to profitability. The notes have rallied to around 96 cents after the company posted two consecutive quarters of positive cash flow.

Uber Technologies Inc. has fared better, having tapped the high-yield market twice despite failing to regularly post a profit. Both of those offerings trade around or above par. Meanwhile, WeWork has become something of a worst-case scenario for debt investors. Its $669 million of junk bonds trade at distressed levels after the company canceled its planned initial public offering and teetered on the brink of insolvency before accepting a bailout package from backer SoftBank Group Corp.

Investors eyeing the Twitter deal have to assess whether the company can garner Netflix-like traction in the bond market, or if its short history of growth and positive cash flow could quickly reverse.

Moody’s Investors Service analyst Neil Begley, who rated the deal the second-highest junk grade, said in a statement that the company has demonstrated “strong revenue growth and free cash flow generation,” but cautioned that “Twitter is small relative to its larger digital advertising and social networking competitors, and user engagement on social networks can be fickle.”

Even some higher-rated, cash-generating technology companies have stumbled. Food delivery platform GrubHub Inc. sold a debut bond in June to enough demand that it increased the size of the offering. But since issuing the debt, it’s struggled to deal with slower growth amid fierce competition in the industry. S&P Global Ratings downgraded the notes in October, and they now trade around 92 cents on the dollar.

“When you engage with the high-yield market, you have to have positive Ebitda and at least a path to cash flow breakeven to even have a discussion,” said John Yovanovic, global head of high-yield at PineBridge Investments. “We’ll approach this one with the scars we learned from GrubHub of what could happen.”

--With assistance from Paula Seligson.

To contact the reporters on this story: Claire Boston in New York at cboston6@bloomberg.net;Molly Smith in New York at msmith604@bloomberg.net

To contact the editors responsible for this story: Nikolaj Gammeltoft at ngammeltoft@bloomberg.net, Boris Korby, Natalie Harrison

©2019 Bloomberg L.P.