Jun 4, 2019

Two Fed Cuts This Year May Be Going Bit Too Far for Some Traders

, Bloomberg News

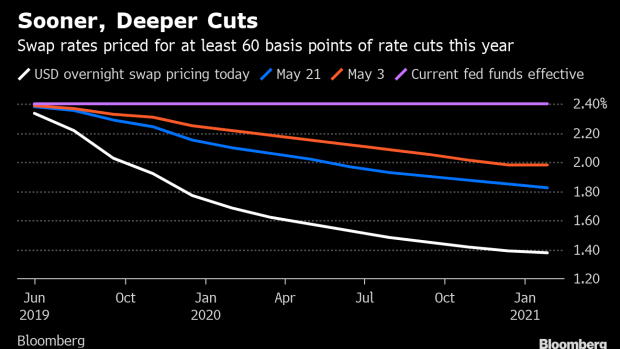

(Bloomberg) -- Some investors are betting that the markets may have gone overboard in pricing two rate cuts from the Federal Reserve by year-end.

Soon after a five-day rally in U.S. Treasuries stalled, one trader paid $4 million in premiums to buy options that would pay off if eurodollar futures fall from current levels. That’s a far cry from others in money markets, who are pricing two quarter point interest-rate cuts by year-end.

Global bond markets have surged in recent weeks amid the escalating trade war between the U.S. and China, which is threatening to end the longest expansion in postwar history. While Treasury yields are at the lowest level in almost two years, those in Europe have touched the lowest levels on record despite the region’s central bank having little wriggle room to cut rates.

The trade in eurodollar options begins to profit at the first strike of 98.25, which was bought, with maximum gains at the second strike, 98.125, which was sold. The underlying eurodollar futures contract -- which is priced off three-month U.S. Libor expectations -- is now hovering around 98.38, or 1.62%, over 90 basis points lower than current Libor levels.

The trader is targeting a profit of around $12.5 million, before costs are deducted.

--With assistance from Edward Bolingbroke.

To contact the reporters on this story: Stephen Spratt in Hong Kong at sspratt3@bloomberg.net;John Ainger in London at jainger@bloomberg.net

To contact the editors responsible for this story: Ven Ram at vram1@bloomberg.net, Michael Read

©2019 Bloomberg L.P.