Mar 10, 2020

Two Leveraged Oil Products to Shut Down in Wake of Epic Crash

, Bloomberg News

(Bloomberg) -- Monday’s spectacular crash in oil prices has claimed its first victims among exchange-traded products: Two highly leveraged instruments in Europe will shutter as a result of the maelstrom.

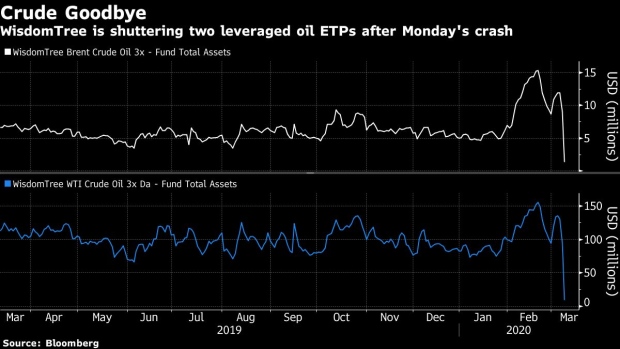

The WisdomTree Brent Crude Oil 3x Daily Leveraged and the WisdomTree WTI Crude Oil 3x Daily Leveraged products will both be terminated “due to an extreme adverse move in oil futures,” according to a notice on the issuer’s website.

The products, which hold a combined $10.3 million in assets, rely on swaps to deliver three times the daily move in crude prices. Those swaps have been closed thanks to the recent price collapse, and the funds themselves will be terminated “as soon as it is practically possible,” the notice states.

“It is important to emphasise that this was an extreme market event impacting long oil products with 3x leverage,” according to the firm. “This does not impact other WisdomTree exchange-traded products at this stage.”

Oil plunged the most in almost three decades this week as Saudi Arabia and Russia vowed to pump more in a battle for market share just as the coronavirus spurs the first decline in demand since 2009. Futures slumped by about 25% in New York and London on Monday.

Several U.S.-listed products also narrowly escaped liquidation the same day. These kinds of moves can represent so-called trigger events that allow issuers to close funds early.

--With assistance from Athanasios Psarofagis.

To contact the reporter on this story: Yakob Peterseil in London at ypeterseil@bloomberg.net

To contact the editors responsible for this story: Sam Potter at spotter33@bloomberg.net, Sid Verma

©2020 Bloomberg L.P.