Dec 11, 2021

Tying Main Credit Lines to ESG Goals Becomes a Norm for Europe

, Bloomberg News

(Bloomberg) -- European high-grade companies are increasingly linking their primary credit facilities to environmental, social and governance objectives as businesses come under pressure to disclose their sustainability credentials.

This group of firms -- including the likes of brewer Anheuser-Busch InBev SA/NV, appliance firm Electrolux AB, and building-materials maker Holcim Ltd. -- has been adding ESG components to their conventional revolving credit lines, which are typically used for liquidity buffers or general working capital, since the first such deal in 2017. The borrowers will get a discount on their interest rates if they reach agreed ESG targets, or a penalty if they fail.

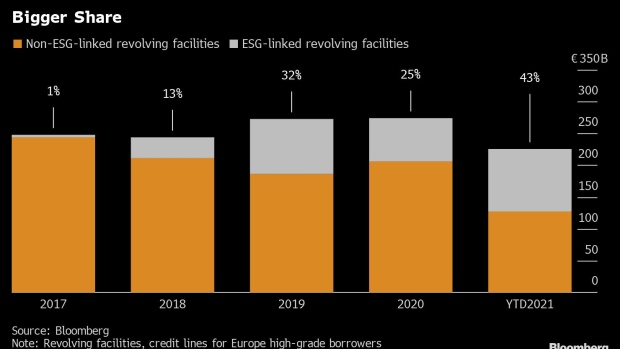

Of the 225-billion-euros ($254 billion) of revolving facilities raised this year, 43% were tied to borrowers’ ESG goals -- a big leap from the 25% in 2020. The 97-billion-euros of so-call ESG or sustainability-linked deals is a 44% jump from the whole of last year, according to data compiled by Bloomberg.

Overall sustainability-linked loan sales in Europe reached a record 156 billion euros so far this year, which was 80% more than full-year issuance seen in 2020. And revolvers made up 62% of the region’s overall sustainability-linked loan sales.

Revolving facilities, the main financing instrument for large corporates in Europe, account for roughly 60% of Europe corporate loans tally, which logged about 420 billion euros year-to-date.

©2021 Bloomberg L.P.