Aug 8, 2022

Tyson Shares Slump Most in Two Years as Inflation Hits Meat Sales

, Bloomberg News

(Bloomberg) -- Tyson Foods Inc., the biggest US meat company, is getting hit by inflation with soaring costs and a tight labor market squeezing sales of chicken and pork.

The owner of Hillshire Farm and Ball Park hot dogs posted adjusted earnings Monday of $1.94 a share for its third quarter, narrowly missing the $1.98 average estimate of analysts surveyed by Bloomberg. Shares fell as much as 9.8%, the biggest intraday tumble since March 2020.

Springdale, Arkansas-based Tyson in a statement said meat sales were slowing with high prices pinching consumers. Pork and chicken sales dropped in the latest quarter; beef sales, while higher volume-wise in the third quarter, are still down for the year to date. Still, total sales in the quarter of $13.5 billion topped estimates for $13.31 billion.

Robust demand for meat has been carrying Tyson, but recession fears sparked by elevated inflation have been prompting shoppers to start to trade down from premium steaks to cheaper cuts and to curb visits to restaurants. At the same time, rising costs for feed has prompted farmers to scale back herds, which will likely raise prices for cattle and hogs in the months ahead. The American cattle herd is already the smallest since 2015.

“You’re going to have more packers chasing these head” of cattle, Tyson Chief Executive Officer Donnie King said. “That’s going to be very tight.”

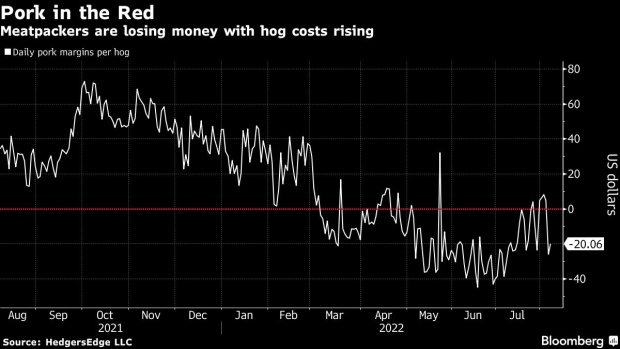

Pork Cut

Tyson in its outlook reiterated expectations for sales in fiscal-year 2022 of $52 billion to $54 billion but it cut estimated margins in the pork segment to between 3% and 5%, down from 5% to 7% in May, and its chicken outlook no longer included expectations for a “stronger performance in the second half of the year.”

Tyson’s miss follows better-than-expected earnings last month from Pilgrim’s Pride Corp., the second-biggest US chicken producer after Tyson.

“The turnaround of our chicken business continues, and we continue to be the market share leader in many of our retail business lines,” said King, who was appointed CEO in 2021 in part to overhaul the chicken segment that had been underperforming after a new male chicken had fertility issues.

Tyson’s results were “a little light of what we were hoping to see, but again trended in the right direction in the recovery of chicken segment profitability,” Stephens Inc. analysts including Ben Bienvenu wrote in a note.

Tyson and other meatpackers have been under fire for soaring meat prices that have been a major contributor to the worst food inflation in four decades. Tyson in a securities filing said it was “unable to agree” with the New York Attorney General’s office on a subpoena regarding a price-gouging probe.

(Updates with shares and comments from investor call)

©2022 Bloomberg L.P.