Sep 21, 2021

U.K. Borrowing 25% Below Forecast in Pre-Budget Boost for Sunak

, Bloomberg News

(Bloomberg) --

U.K. government borrowing was well below official forecasts in the first five months of the fiscal year, providing a fillip for Chancellor of the Exchequer Rishi Sunak as he prepares for a review of tax and spending next month. The budget deficit totaled 93.8 billion pounds ($128 billion) between April and August, the Office for National Statistics said Tuesday. That’s 25% under the 125.7 billion pounds predicted by the Office for Budget Responsibility in March. The deficit in August alone stood at 20.5 billion pounds, higher than economists had forecast.

The latest figures included an upward revision to borrowing in the last fiscal year after the ONS incorporated the cost of writing off expected losses on the 80 billion pounds of loans made to companies hit by the pandemic. This, plus other smaller changes relating to pensions, raised the deficit in the 2020-21 to 325 billion pounds from a previously estimated 298 billion pounds. The undershoot for the current year, which reflects a stronger-than-expected recovery from the coronavirus recession, may allow the fiscal watchdog to cut borrowing projections for the current fiscal year that ends in March. That would give Sunak some fiscal leeway when he presents his budget along with a three-year review of departmental spending on Oct. 27. However, economists say any tax and spending giveaways are likely to be limited, given the scale of the task facing Sunak to repair the fiscal damage wrought by the coronavirus pandemic.

In a sign of his determination to get the public finances under control, Sunak this month raised payroll taxes to cover a 12 billion-pound boost for health and social care, rather than borrowing to pay for it.

Hanging over the announcement is the threat from higher inflation, which is pushing up the cost of government debt tied to the retail price index. The Treasury would face additional debt costs if the Bank of England starts raising interest rates next year, as economist increasingly expect.

Education and transport as well as additional spending on the National Health Service are also likely to exert further pressures on the public purse beyond this year as Prime Minister Boris Johnson seeks to deliver on his pledge to “level up” poorer areas of the U.K.

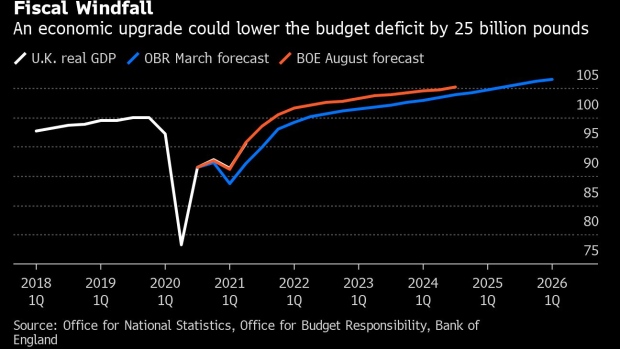

Crucially, the government’s room for maneuver also depends on the OBR’s assessment of the long-term loss of output caused by the pandemic. The Institute for Government calculates Sunak would get a 25 billion-pound windfall if the economy follows the path projected by the BOE, which puts the hit at about 1.25% rather than the 3% estimated by the OBR in March.

©2021 Bloomberg L.P.