May 17, 2019

U.K. Brexit Drama Hurts European Car Sales for Eighth Month

, Bloomberg News

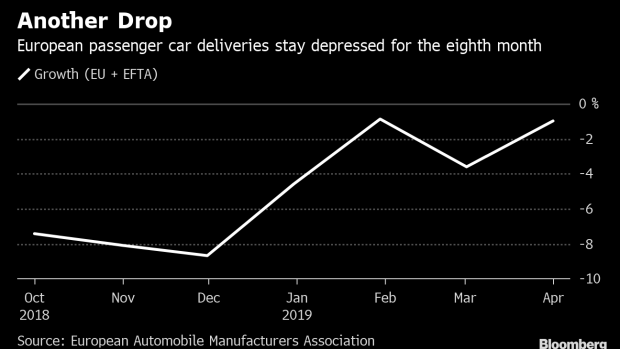

(Bloomberg) -- European car sales declined for an eighth straight month in April amid weak demand in the U.K., where consumers are putting off big-ticket purchases due to Brexit turmoil.

Monthly deliveries in the region dropped 1% to 1.22 million cars, the European Automobile Manufacturers Association said Friday. The decline was a steeper 4.1% in the U.K., where Goldman Sachs Group Inc. has concluded three years of political uncertainty have left the economy 2.4% smaller than it otherwise would have been. Economic growth is forecast to slow there in 2019.

During the first four months of the year, European car registrations declined 2.9% to 5.01 million cars, with Italy and Spain leading the slump among the five major markets with drops of 4.6% and 4.5% respectively.

The weak showing in Europe mirrors poor sales in China, the world’s biggest car market, where demand in April plummeted 16.6% to further solidify the worst slump in a generation. The broad slowdown is undermining carmakers’ plans for record spending toward the shift to electric cars.

A softer market is adding to headwinds for the manufacturers, with BMW AG and Daimler AG turning to cost-saving measures to remedy sliding profits. Pressures are set to intensify next year in the EU due to tighter regulation on carbon dioxide emissions. Sales of electric vehicles remains at a fraction of total deliveries.

U.S.-China trade tensions have also put the car industry on alert. President Donald Trump will give the European Union and Japan 180 days to agree to a deal that would “limit or restrict” imports into the U.S. of automobiles and their parts in return for delaying new auto tariffs, according to a draft executive order seen by Bloomberg.

To contact the reporter on this story: Elisabeth Behrmann in Munich at ebehrmann1@bloomberg.net

To contact the editors responsible for this story: Anthony Palazzo at apalazzo@bloomberg.net, Tara Patel

©2019 Bloomberg L.P.