Apr 19, 2022

U.K. Faces Worst Inflation Shock Among G-7 Nations, IMF Warns

, Bloomberg News

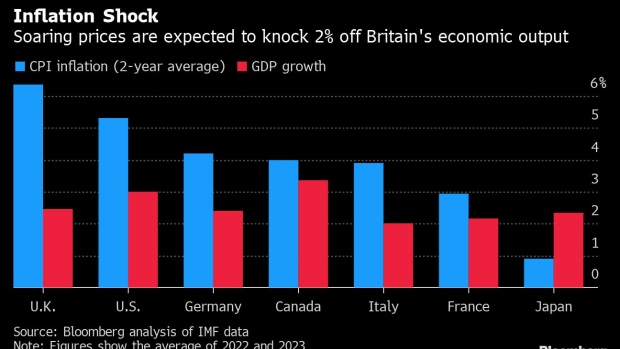

(Bloomberg) -- Britain faces the worst inflation shock of all major advanced economies over the next two years, the International Monetary Fund warned as it slashed its growth forecast.

The global watchdog said the U.K. economy will be around 1% smaller in both 2022 and 2023 than it forecast in January. It blamed the downgrade on the cost of living crisis and slowing investment as interest rates rise to tackle rocketing consumer prices.

No other Group of Seven nation had its outlook lowered across the two years by as much. In 2023, the U.K. is expected to grow more slowly than the rest, just behind France.

Consumer prices in the U.K. will increase 7.4% this year, and by a further 5.3% in 2023, the IMF said in its World Economic Outlook published Tuesday. Inflation is forecast to be below 3% for every other major advanced economy next year.

The projections underline the scale of the policy challenge facing the Bank of England and the U.K. Treasury, as they balance a starker trade-off between flagging growth and soaring prices than peers.

Living Standards Squeeze

Britain has only just recovered all the output lost in the pandemic but households now face the steepest fall in living standards since the 1950s as inflation outpaces wages and personal taxes rise.

The IMF said the problems in global supply chains that have driven up costs pre-dated the war in Ukraine but the conflict has deepened the crisis across the world.

The IMF did not explain why the U.K. faces the worst inflation shock but economists have pointed out that it is an open economy that is highly exposed to global energy market prices.

The IMF said the U.K. was downgraded because “consumption is projected to be weaker than expected as inflation erodes real disposable income, while tighter financial conditions are expected to cool investment.”

Growth is cut by 1 percentage point this year to 3.7% and by 1.1 point next year to 1.2%. Excluding the pandemic, that would be the worst year of growth since the 2009 recession.

Inflation this year will not as bad as the 7.7% seen in the U.S., but consumer prices drop back sharply in America in 2023 while remaining elevated in the U.K.

The IMF said strong wage growth in the U.K. due to job shortages and skill mismatches was a contributory factor.

It urged advanced central banks to tighten monetary policy and warned that rising inflation and interest rates meant governments had less fiscal space to support their economies than before.

©2022 Bloomberg L.P.