Jan 27, 2022

U.K. Retail Trading Platforms See Renewed Demand in Wild Markets

, Bloomberg News

(Bloomberg) --

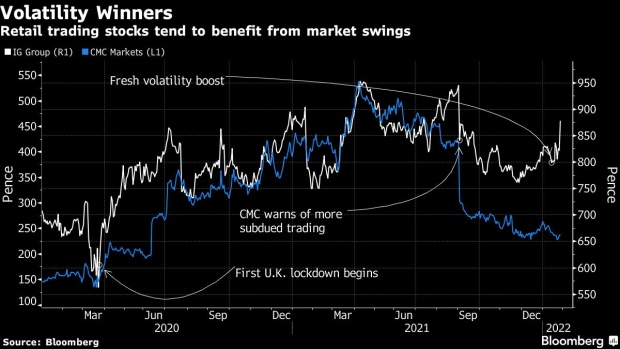

A volatile start to the year for global stock markets is breathing new life into U.K. trading platforms, which had seen fading interest amid less stringent pandemic restrictions.

CMC Markets Plc and IG Group Holdings Plc both said they’ve seen an increasing number of bets being placed on equity markets amid price swings that put the S&P 500 Index on course for its worst month since March 2020. Headlines on tightening U.S. monetary policy as well as geopolitical tensions in eastern Europe have been a “call to trade,” according to CMC’s deputy Chief Executive Officer David Fineberg.

“As markets are interesting, people are trading,” June Felix, chief executive at IG Group, said in a phone interview. Both firms offer contract-for-difference products that allow clients to bet on market moves without owning the underlying securities.

Retail trading firms around the world got a boost during pandemic lockdowns, as the combination of volatile markets and customers stuck at home -- with more time on their hands and, in some cases, extra cash to spend -- spurred demand for platforms like CMC’s and IG’s. The so-called meme-stock craze that spurred huge rallies in shares such as retailer GameStop Corp. and cinema group AMC Entertainment Holdings Inc. also added to trading volumes.

While retail trading activity has ebbed as the pandemic evolves, the market fluctuations seen this year have been a new boon for the platforms. Volatility has spiked since the turn of the year, with the Cboe Volatility Index -- also known as the VIX -- jumping more than 80%. That has provided more opportunities to speculate.

Data from investing platform operator AJ Bell Plc, meanwhile, suggest the retail crowd is buying the dip in some U.S. technology stocks amid earnings reports. Tesla Inc., Netflix Inc. and Microsoft Corp. are among the top 10 purchases on the site this week.

Retail accounted for 18.5% of trading in the U.S. in the fourth quarter, down from 24% in the first quarter of 2021, according to Bloomberg Intelligence, while former meme-stock darlings have tumbled rapidly this year. It remains to be seen how market moves have changed market participation by retail traders so far this year.

CMC’s Fineberg said in an interview that January’s market swings are more manageable than those seen in 2020, with customer accounts less likely to be liquidated. “They present opportunities, but they’re not flash crashes whereby you can potentially lose part of your client base,” he said.

Shares in CMC have fallen 2.1% over the past two weeks, while those in IG are up 8%, both outperforming sharp declines for the S&P 500 and the tech-heavy Nasdaq 100 in the period.

©2022 Bloomberg L.P.