Aug 12, 2020

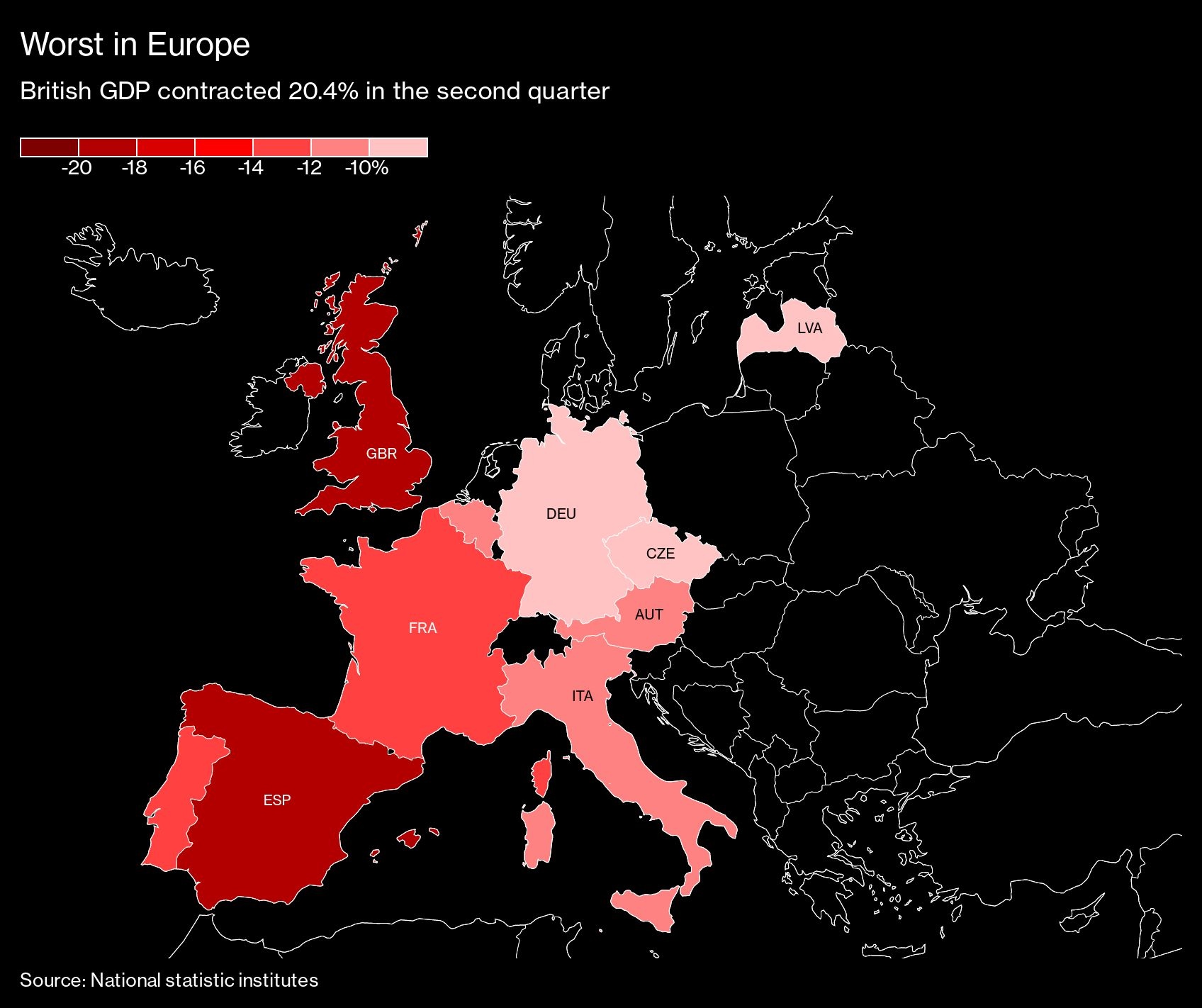

U.K.'s worst slump in Europe raises pressure to sustain rebound

, Bloomberg News

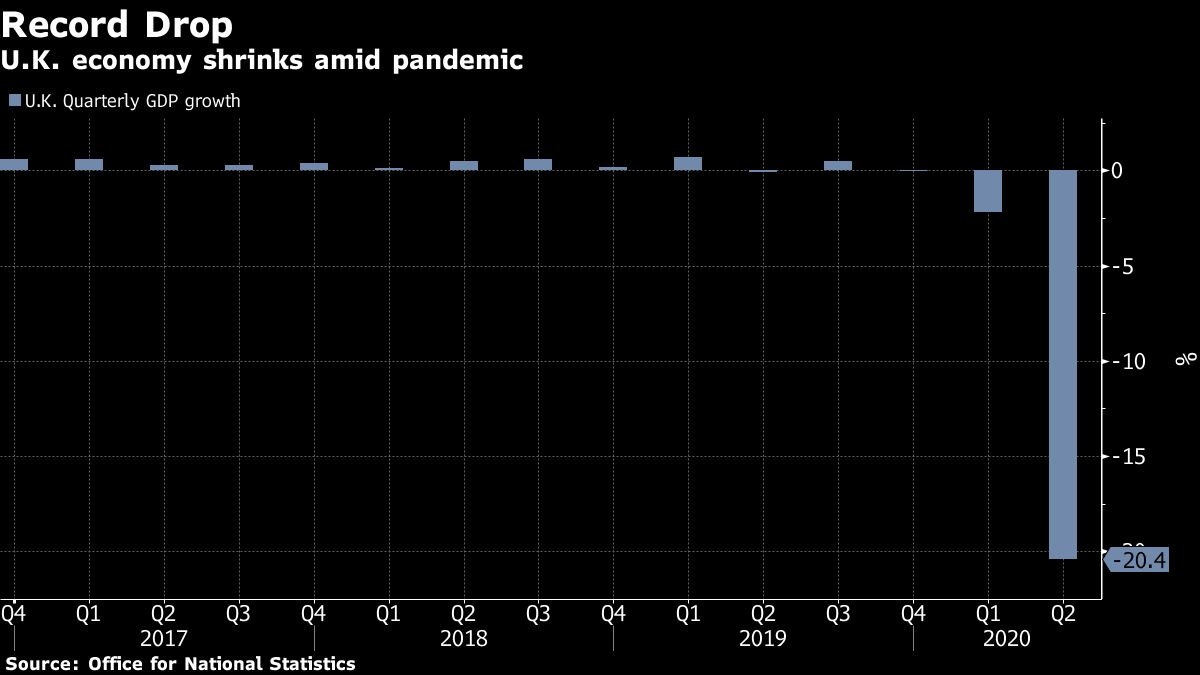

Gross domestic product plunged 20.4 per cent in the second quarter, the most since records began in 1955 and roughly double that of Germany and the U.S. It also pushed Britain into its first recession since 2009.

The report followed massive job losses since the start of the pandemic, and Chancellor of the Exchequer Rishi Sunak acknowledged that more pain is to come.

“I’ve said before that hard times were ahead, and today’s figures confirm that hard times are here,” he said following the release. “Hundreds of thousands of people have already lost their jobs, and sadly in the coming months many more will.”

That casts a light on the risks of winding down government support for companies and workers too soon. Almost 10 million jobs have been put on furlough programs under which the government pays the wages. Sunak, who has borrowed tens of billions of pounds to finance spending, insists the time has come to start phasing the plan out, although his critics say it should be extended.

'Tricky job'

“Sunak has got a tricky job,” said James Smith, developed markets economist at ING. “There’s no easy answer to the Job Retention Scheme and that’s the main risk at the moment as that is unwound. There’s a real chance that the recovery stalls if unemployment broadens out.”

A rebound is under way -- U.K. output jumped a record 8.7 per cent in June, beating forecasts -- but high frequency data such as credit card spending and electricity use are still well below pre-pandemic levels. They’ve more or less recovered in other major European economies, according to Bloomberg Economics.

The U.K. economy has been hit particularly hard because of its reliance on services and “social consumption,” such as eating out and shopping. And there are worrying signs that the upturn could soon run out of steam.

Localized jumps in infections have heightened concerns over more shutdowns, government wage support is being phased out, and companies face higher tariffs should Britain fail to agree a trade deal with the European Union by the end of the year.

Prime Minister Boris Johnson has come under fire for failing to respond quickly enough to the virus, and the opposition Labour Party wasted no time in blaming his government for the scale of the slump.

“A downturn was inevitable after lockdown -- but Johnson’s jobs crisis wasn’t,” said Shadow Chancellor Anneliese Dodds. “Now he must take responsibility, scrap the one-size-fits-all withdrawal of wage support and bring the health crisis properly under control.”

Economists and investors expect the Bank of England to boost its monetary stimulus later this year by increasing bond purchases. The central bank has already pumped billions of pounds into the financial system and has cut its key interest rate to near zero.

Sunak on Wednesday once again ruled out a return to austerity to repair the huge fiscal damage inflicted by the pandemic, but warned of “difficult decisions” ahead -- a hint that higher earners could face tax increases. The chancellor is due to hold a budget in the autumn.

U.K. government bonds signal continued pessimism toward prospects of a swift economic recovery. Yields on five-year debt, while rising, are still among the lowest points on the curve in a sign that the market still expects the BOE to ease further.

What Bloomberg’s Economists Say...

“Stimulus provided by reopening the economy is likely to push output higher over the summer, but the recovery will likely lose steam in the fall. We expect the BOE to ease as the rebound proves less complete than set out in its forecasts last week, though we now think there’s a risk that more stimulus comes in early 2021 rather than the end of this year.”

-- Dan Hanson, senior U.K. economist. Read his full REACT.

The latest figures add to evidence Britain is paying a heavy price for being slower than most of its peers to enter a lockdown in March, with GDP slumping to its lowest level since 2003 last quarter. The country also has Europe’s highest death toll from the coronavirus, and probably has the worst downturn of any major economy worldwide.

The damage in the second quarter was widespread, with the construction industry alone seeing a 35% contraction. The report also showed:

Services, the biggest part of the economy, shrank 20% and industrial production plunged 17%.

Government spending fell 14%, while business investment plunged 31.4%, and consumer spending declined 23.1%

Productivity, as measured by output per hour, fell a record 2.5%

The peak to trough decline in GDP between February and April was 25.6%

The BOE has highlighted the labor market as a key concern, with officials fearing a jump in unemployment when government job support is withdrawn later this year. Data Tuesday showed the number of employees on payrolls is already down around 730,000 compared with March.

The central bank warns that the longer the recovery takes, the greater the risk of economic “scarring.”

--With assistance from Zoe Schneeweiss, Harumi Ichikura, James Hirai, Tim Ross and Brian Swint.