Sep 18, 2019

U.K. Set to Open $25 Billion Contest for Offshore Wind Farms

, Bloomberg News

(Bloomberg) -- The U.K. is set to open the first contest in a decade intended to draw as much as 20 billion pounds ($25 billion) of investment in offshore wind farms.

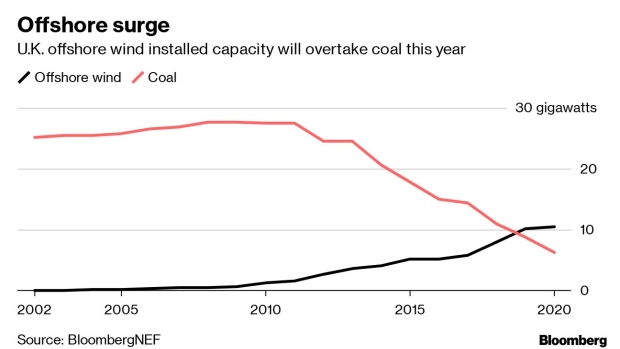

The move in a competitive auction for leases where developers can plant large-scale turbines at sea will bring at least 7 gigawatts of new power generation capacity to the U.K. grid and speed up a shift toward cleaner energy supplies.

Britain is pushing both to reduce fossil fuel emissions that cause climate change and replacing nuclear and coal plants that regulators say must close within the next few years. The government has estimated it may need 100 billion pounds of investment over a decade or more to upgrade its aging power networks.

“With the tremendous cost reduction that’s happened with offshore wind, the technology will have a key role to play in de-carbonizing the U.K. energy system,” Huub den Rooijen, director of energy, minerals and infrastructure at the Crown Estate, which is conducting the action.

Crown Estate, which manages the waters around England, Wales and Northern Ireland, will auction leases for offshore wind development in four areas in waters around Britain. The announcement kicks off a process for developers to submit proposals for leasing rights to the areas that could lead to billions of dollars of investment.

Building turbines at sea was once seen as niche within renewable energy, but after costs plunged in the past few years the technology is becoming more attractive to utilities.

The plots will support between 7 gigawatts and 8.5 gigawatts of new offshore wind farms. They will be bult in areas known as: Dogger Bank Bidding Area, Eastern Regions Bidding Area, South East Bidding Area and Northern Wales and Irish Sea Bidding Area.

The areas adjoin a number of existing offshore wind projects and were chosen partially for the depth of less than 60 meters to the seabed.

Developers will now begin to qualify to bid in the auction, assess the seabed areas and propose project sites. The Crown Estate could award rights as early as 2021. The winners would then have to get project planning approval and win contracts to deliver power. The projects could start to generate power late next decade.

Future Auctions

Much has changed in the world of offshore wind since the last round of seabed auctions were held in 2010. In addition to plunging costs, developers are also more experienced and turbines are much bigger.

The change in the industry, coupled with the U.K.’s ambitious goals to lower carbon emissions, may mean developers won’t have to wait another 10 years before the next round of seabed auctions.

“I’d expect that before long we’d be coming forward with further leasing rounds,” said den Rooijen, without being more specific.

That will depend on market demand as well as technology. Future leasing rounds could also take into account the needs of floating wind turbines, which can operate in deeper waters than the fixed-bottom turbines currently in use.

--With assistance from Samuel Dodge.

To contact the reporter on this story: William Mathis in London at wmathis2@bloomberg.net

To contact the editors responsible for this story: Reed Landberg at landberg@bloomberg.net, Lars Paulsson

©2019 Bloomberg L.P.