Jul 9, 2020

U.S. Bond Investors’ Guide to Best Returns Points to Euro Area

, Bloomberg News

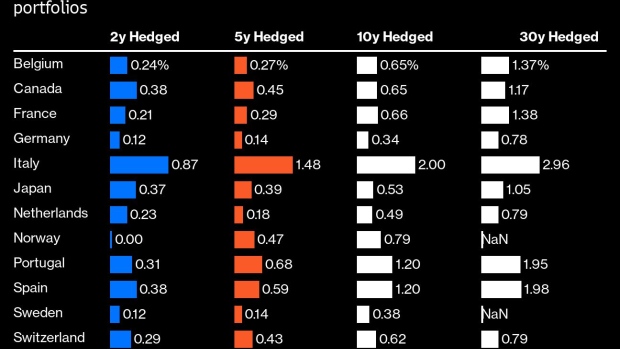

(Bloomberg) -- Europe’s peripheral debt is the best place to be for U.S.-based investors seeking the highest currency-hedged returns in developed markets.

Two-year securities in Italy provide returns approaching 1%, a far cry from comparable notes that offer about 0.16% in the U.S., a study of developed markets shows. Further out along the yield curve, bonds of Italy, Spain and Portugal lead the pack by a considerable margin. They’re unlikely to be surpassed for some time given the current lower-for-longer global interest-rate regimes following the impact of the pandemic.

Of the 13 markets included in the study, only two -- Italy and Spain -- are markets where dollar-domiciled portfolio managers can lock in returns of 2% or above. Portugal’s 30-year notes may also offer a return of that magnitude on a given day with just a small shift in the forwards’ markets.

Returns above 2% have been endangered following the pandemic and were last available to U.S. investors from 30-year Treasuries in February. That’s vastly different from the state of play just a couple of years ago, when the alchemy of currency-hedged returns could produce returns of about 7%. This collapse means that fund managers have to go down the credit spectrum to find higher yields, a factor that also explains the disconnect between stocks and the economy, as previously noted.

Italy’s yields have proven irresistible to money managers despite the nation’s burgeoning deficit figures and crumbling economic growth. The European Union’s 750-billion euro recovery plan -- if passed -- provides a fiscal backstop for Italian notes, while the European Central Bank’s asset and pandemic emergency purchases present a monetary backstop. In April, Italy earned a reprieve from S&P Global Ratings, which left the country’s rating intact and cited the ECB among the reasons.

At the other end of the spectrum, German bonds and gilts offer much lower returns than Treasuries across the five- to 30-year maturities. Even Japanese government debt offers more meaningful returns once currency risks are hedged, making German and U.K. bonds the most expensive in the world.

NOTE: Ven Ram is a currency and rates strategist for Bloomberg’s Markets Live. The observations are his own and not intended as investment advice.

©2020 Bloomberg L.P.